Ripple Exec Warns: Banks Without A Stablecoin Strategy ‘Will Get Left Behind’

Ripple’s Middle East and Africa boss has a blunt message for the banking sector: if you still do not have a stablecoin strategy, you are already behind the curve.

“Look, I think there’s no bank, financial institution, payment entity that is not thinking, talking or incorporating a stablecoin strategy,” Ripple’s Reece Merrick told CNBC in Abu Dhabi. “And quite frankly, if they’re not, they will get left behind.”

Ripple’s Advantage In The Stablecoin Space

The interview came right after a significant regulatory win. Ripple’s USD-backed stablecoin, RLUSD, has been recognized by Abu Dhabi’s Financial Services Regulatory Authority (FSRA) as an “Accepted Fiat-Referenced Token,” allowing ADGM-licensed institutions to use it for regulated financial activity. For Ripple, this is less about marketing and more about foothold: it embeds RLUSD inside one of the Gulf’s most aggressively pro-crypto regulatory hubs.

“Firstly, what this does is it further validates Ripple’s value proposition here in the region and a compliance-first approach as it relates to issuing our own stablecoin, RLUSD, at the back end of last year,” Merrick said. The approval means ADGM entities can “utilize RLUSD within their flows, within their operations,” which he called “a great step forward for Ripple, great step forward for the region.”

The compliance drumbeat is deliberate. Before pushing RLUSD globally, Ripple went to what Merrick described as “the gold standard of regulators,” the New York Department of Financial Services, which oversees RLUSD issuance. The combination of NYDFS in the US and FSRA (plus Dubai’s DFSA, which earlier approved Ripple as the first blockchain-enabled payment solution provider) is meant to send a clear signal: this is an institutional product, not a fly-by-night dollar token.

The hard numbers are more modest. RLUSD has about 1.2 billion dollars in circulation, tiny next to Tether’s roughly 120 billion. Merrick did not try to spin that away; instead he pointed at the direction of travel. The stablecoin market is around 300 billion dollars today, he noted, dominated by USDT and USDC, but Ripple expects it “to be moving into the trillions” with “share for everyone.”

How to carve out that share is where Ripple’s strategy gets more specific. Merrick said Ripple wants RLUSD “to be the gold standard for institutions to adopt this stablecoin,” and he anchored that in concrete rails: recent acquisitions and existing payment volume.

He highlighted G-Treasury, a treasury management platform that sees “how Fortune 500 businesses are moving trillions of dollars between their own operations,” and Hidden Road, now rebranded as Ripple Prime, a prime broker that “turn[s] over three trillion in prime brokerage.” Ripple’s plan is to bake RLUSD directly into those flows. Since announcing GTreasury, Merrick said, the company has seen “so much inbound” from institutions exploring RLUSD for their internal operations.

Underneath sits Ripple’s long-running cross-border payments business, which has processed about 95 billion dollars in turnover using XRP and the XRP Ledger. RLUSD, Merrick argued, is a “natural step” after persistent customer demand for stablecoin payouts. With roughly half of global cross-border payments made in dollars and many of those not actually destined for the US, he called existing channels “inefficient and slow,” and positioned regulated dollar tokens as a cleaner alternative.

Trust and understanding are still the industry’s biggest problems, as CNBC’s Dan Murphy noted, citing boardroom confusion and skepticism even at Abu Dhabi Finance Week. Merrick’s response was predictable but also, frankly, the only credible one: stack regulation, collateral transparency and real-world utility until the narrative changes.

“Trust is paramount,” he said, pointing again to NYDFS, ADGM and DFSA approvals as the anchor. Once “large financial institutions, these large corporates” see the impact on their own business, he expects “that kind of hockey stick growth.”

He also highlighted the GENIUS Act in the US as having “paved the way for some of the largest global financial institutions to kind of play in this space,” shorthand for the broader legislative shift toward regulated stablecoin frameworks.

Taken together, Merrick’s remarks sketch a simple line in the sand. Stablecoins are no longer a side experiment; they are becoming core payments and treasury infrastructure. And for banks still stuck at the “internal working group” stage, the message from Ripple’s regional chief could not have been clearer: get a stablecoin strategy, or get comfortable watching your customers migrate to those who already do.

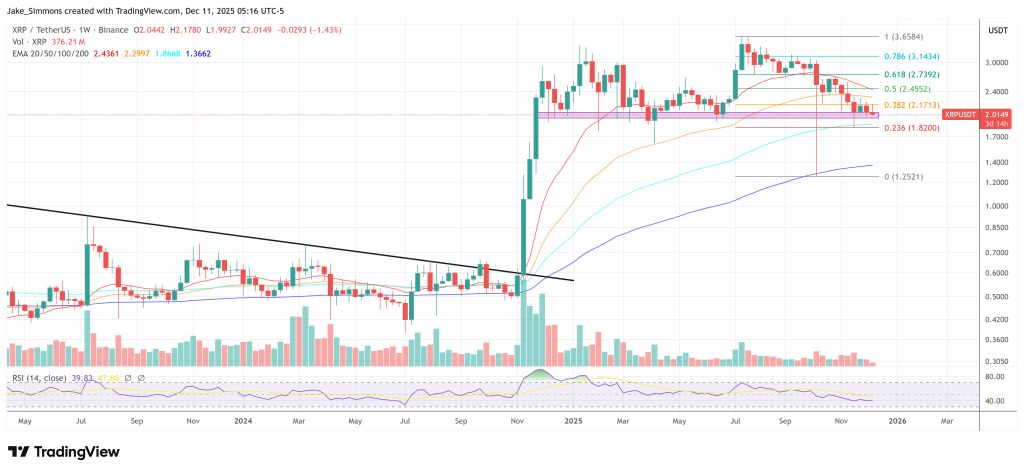

At press time, XRP traded at $2.0149.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon