State Street Bank and Galaxy will launch a tokenized liquidity fund on the Solana blockchain next year.

PANews reported on December 11th that, according to CoinDesk, State Street and Galaxy Asset Management plan to launch a tokenized liquidity fund in early 2026. This fund will use stablecoins to enable 24/7 investor liquidity, thereby expanding the application of public blockchains in institutional cash management. The fund, named "State Street Galaxy Onchain Liquidity Sweep Fund" (SWEEP), will accept subscriptions and redemptions in PayPal's stablecoin PYUSD, provided the fund has available assets to process related requests. Only qualified buyers meeting predetermined thresholds will be able to invest in the fund. Ondo Finance has committed approximately $200 million as seed funding for the product. The two companies expect the SWEEP fund to launch on the Solana blockchain initially, followed by Stellar and Ethereum blockchains. Galaxy Asset Management plans to leverage Chainlink's tools to enable cross-chain data and asset transfers.

You May Also Like

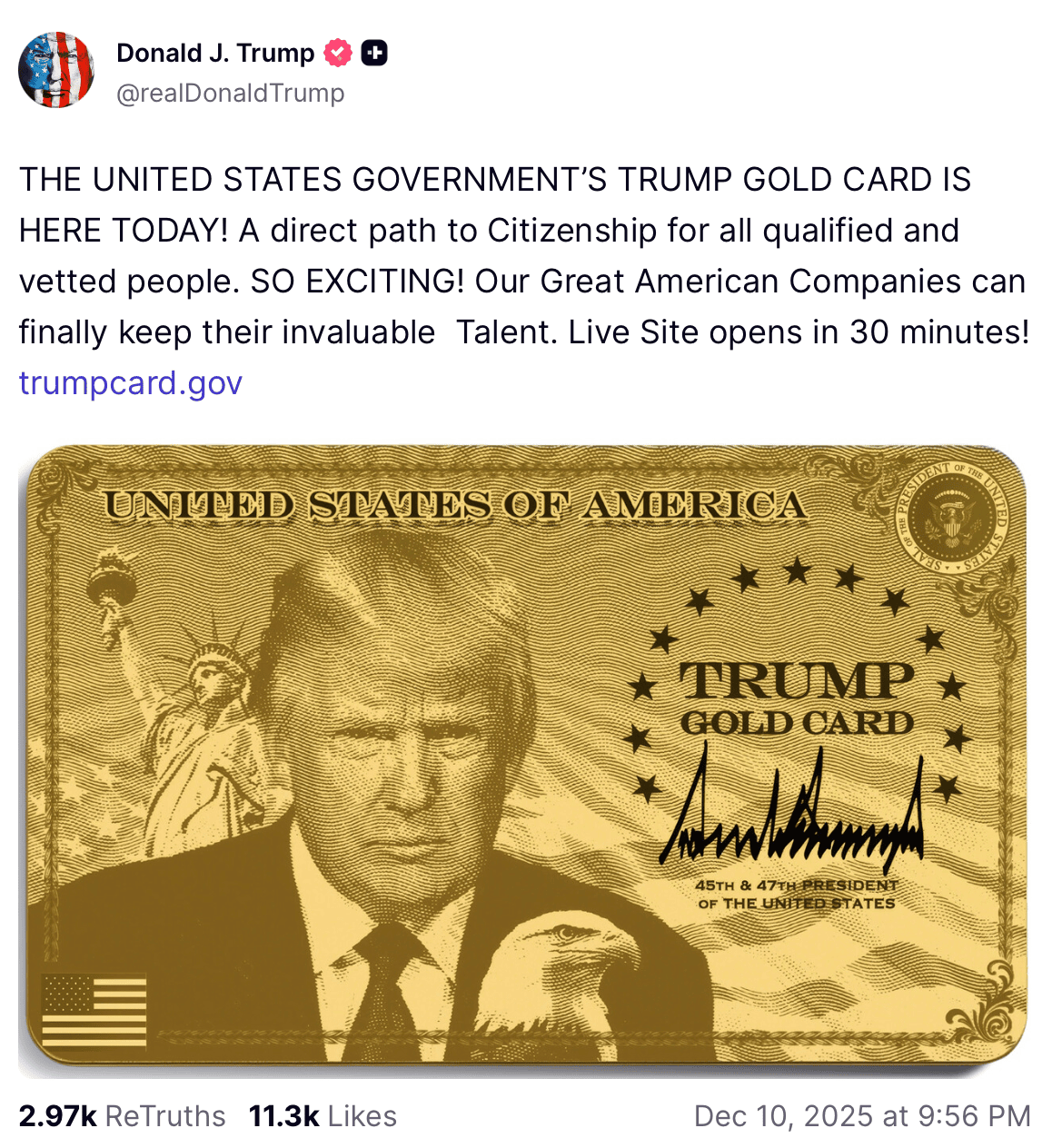

Trump Announced the Launch of the Trump Gold Card

Vitalik Buterin Suggests Ethereum Security Intact Amid Recent Glitch