Johor Regent Unveils Ringgit-Backed Stablecoin to Strengthen Malaysia’s Digital Economy

TLDR

- Malaysia’s RMJDT stablecoin launches, pegged to the ringgit for cross-border trade.

- Johor Regent introduces RMJDT stablecoin on Zetrix blockchain for economic growth.

- RMJDT stablecoin aims to attract foreign investment and simplify payments in Malaysia.

- Malaysia’s RMJDT stablecoin backed by ringgit deposits and government bonds.

- Bullish Aim sets up Digital Asset Treasury to ensure RMJDT’s stability and growth.

Malaysia’s Johor Regent, Tunku Ismail Sultan Ibrahim, has launched RMJDT, a stablecoin pegged to the Malaysian ringgit. The new digital currency, issued by Bullish Aim Sdn Bhd, is aimed at facilitating cross-border trade and attracting foreign investment in Malaysia. RMJDT is set to play a central role in the country’s growing blockchain infrastructure, supporting the national digital economy.

The stablecoin will be initially backed by ringgit cash deposits and short-term government bonds, with a total supply of 500 million tokens. This initiative positions Malaysia as a competitive player in the growing digital asset market across the Asia-Pacific region. RMJDT aims to simplify and enhance the efficiency of transactions, offering a faster and safer alternative to traditional payment methods.

Stablecoin Issued on Zetrix Blockchain

RMJDT is issued on the Zetrix blockchain, a platform developed by Zetrix AI and designed to support Malaysia’s Digital Asset National Policy. The blockchain is integral to the Malaysian Blockchain Infrastructure (MBI), a government-backed platform unveiled earlier this year. The partnership between Bullish Aim and Zetrix ensures that the stablecoin is closely aligned with Malaysia’s digital economy goals.

The collaboration reflects Malaysia’s continued investment in blockchain technology. It also underscores the nation’s commitment to enhancing its financial ecosystem by adopting innovative solutions. The launch of RMJDT is expected to increase the international use of the Malaysian ringgit, especially in cross-border trade.

Digital Asset Treasury Supports RMJDT Stability

Bullish Aim plans to establish a Digital Asset Treasury Company (DATCO) with an initial allocation of RM500 million in Zetrix tokens. This treasury will ensure stable network gas fees for RMJDT transactions. DATCO will also stake Zetrix tokens to support up to 10% of the validator nodes within the Malaysia Blockchain Infrastructure, ensuring long-term security and operational efficiency.

DATCO’s role is critical for maintaining operational stability and supporting Malaysia’s blockchain ecosystem. As part of the initiative, the company plans to increase the treasury to RM1 billion. This move reflects Bullish Aim’s strategy to foster the growth of digital assets while reinforcing Malaysia’s position as a leader in digital finance within the region.

RMJDT Aligns with Malaysia’s Economic Goals

The introduction of RMJDT is a direct response to growing trends in digital currency adoption across Asia. As governments and businesses across the region explore blockchain and stablecoins, Malaysia aims to establish a regulatory framework that supports such innovations. The launch also aligns with Malaysia’s Digital Asset National Policy, which encourages responsible innovation and regulatory oversight in the crypto sector.

Bullish Aim’s move to launch RMJDT under a regulated sandbox framework ensures compliance and transparency in the digital asset space. This is crucial for establishing Malaysia as a reliable hub for blockchain and cryptocurrency ventures. The introduction of RMJDT marks an important step in Malaysia’s efforts to integrate digital currencies into its financial ecosystem.

The post Johor Regent Unveils Ringgit-Backed Stablecoin to Strengthen Malaysia’s Digital Economy appeared first on CoinCentral.

You May Also Like

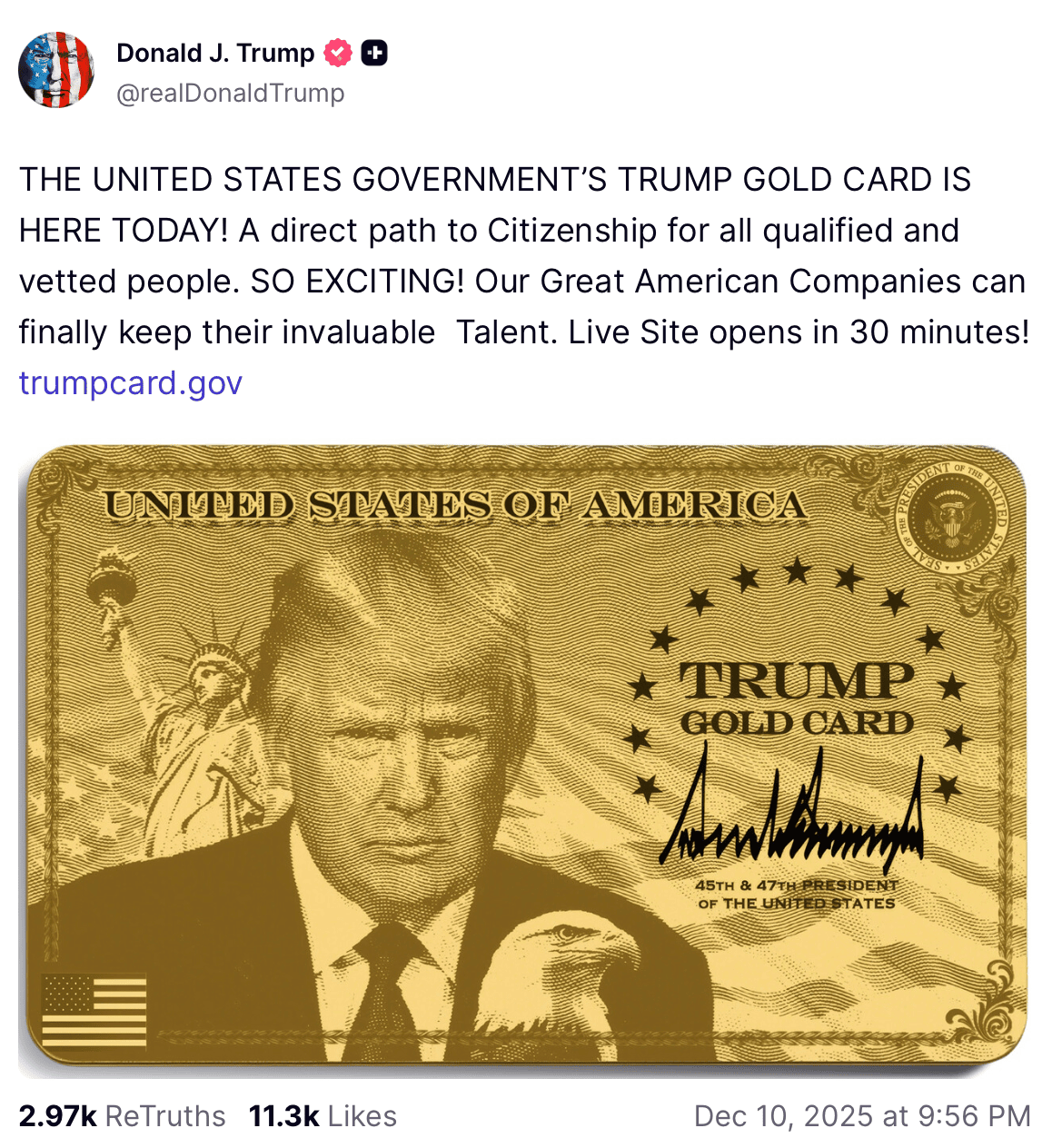

Trump Announced the Launch of the Trump Gold Card

Vitalik Buterin Suggests Ethereum Security Intact Amid Recent Glitch