SOL Price: Why Solana Could Explode as Bitcoin Builds Toward a Major Breakout

The post SOL Price: Why Solana Could Explode as Bitcoin Builds Toward a Major Breakout appeared first on Coinpedia Fintech News

The SOL price could explode in December, many are upvoting this as Bitcoin and SOL price regains strength ahead of the December 10 FOMC meeting in sync. This setup is critical because, historically, Solana tends to follow the king crypto’s trend, and current market structure suggests SOL may mirror BTC’s next major breakout if liquidity conditions turn favorable.

BTC and SOL Track the Same Market Rhythm

The current landscape shows the Solana crypto market closely mirroring Bitcoin’s trajectory. Both assets peaked on October 6 during Q4 2025 and then entered a multi-week cooldown phase.

However, from November 21 onward, the trend shifted. Both BTC and SOL began stabilizing and started trading near crucial daily-timeframe support zones, indicating a potential synchronized rebound activity.

This alignment matters right now the most because historically, when the BTC/USD structure strengthens, the SOL price often reacts with amplified volatility. The similarity in their Q4 movements adds weight to the argument that Solana crypto may be gearing up for a sharp continuation once Bitcoin triggers the next major wave.

Trendline Strength and EMA Barriers Define the Short-Term Setup

From a technical standpoint, the Solana price chart highlights an 18-day rising trendline where buyers have consistently defended dips. However, the 20-day EMA remains a ceiling for both BTC and SOL, temporarily restricting momentum.

Yet, external catalyst supports the breakout odds, both structures appear primed for acceleration. For SOL/USD, reclaiming $144 is the first step, while BTC faces its own barrier near $94,495.

Once these levels are cleared, the charts suggest the next magnet zones sit near $173 for SOL and $103,816 for BTC. These aims align with the broader SOL price prediction December 2025 and the target aligns well with the 200-day EMA band.

FOMC Decision Becomes the Critical Catalyst

The December 10 FOMC meeting is central to the narrative. An expected 0.25% rate cut could significantly boost liquidity, allowing both assets to break their resistance levels. In such a scenario, the SOL price USD outlook becomes exceptionally bullish for December, with extension potential into Q1 2026.

Conversely, a rate-hold scenario could trigger a retest of lower support zones. Despite this risk, long-term positioning remains strong due to liquidity trends and accumulation behavior.

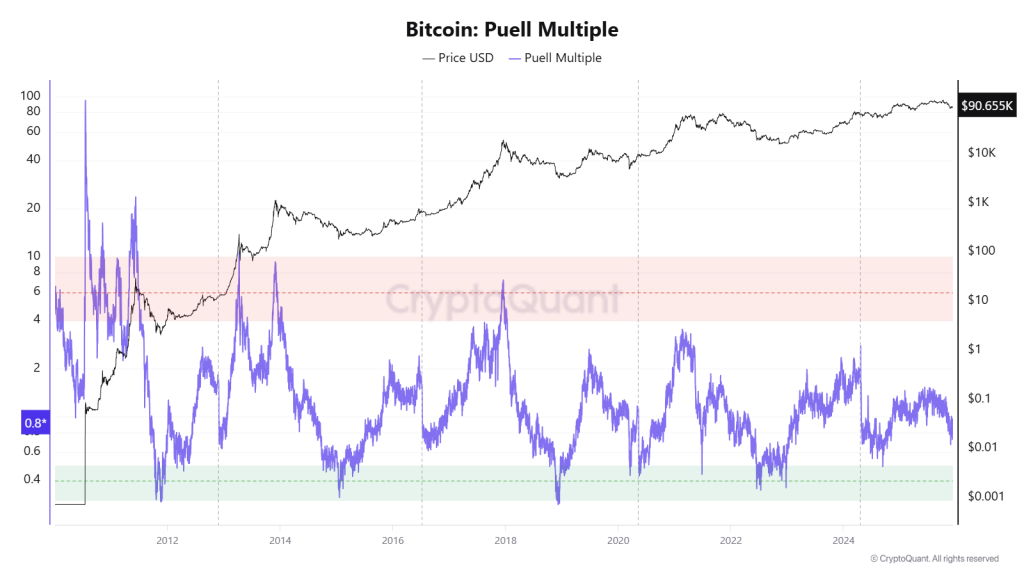

Puell Multiple and Whale Behavior Strengthen the Bull Case

A major insight fueling confidence is the latest Puell Multiple reading of 0.8, far below the “cycle top” zone above 6. This suggests the real Bitcoin bull phase has not even started. Whales continue accumulating, implying deep conviction in upcoming upside.

If Bitcoin’s next leg ignites, Solana remains one of the strongest contenders to outperform based on past cycle behavior and ongoing structural strength.

Ultimately, the SOL price is in sync with Bitcoin’s recovery structure, for now, supported by rising trendline strength, favorable liquidity signals, and macro conditions that may soon turn decisively bullish. If BTC breaks out following the FOMC decision, Solana could be positioned for one of its strongest short-term rallies in recent months.

You May Also Like

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets

Wormhole Unleashes W 2.0 Tokenomics for a Connected Blockchain Future