Best Crypto Presales: Low Cap Gems Set to Explode Before Year-End

As the broader cryptocurrency market slowly regains stability, the meme coin sector is beginning to show early signs of recovery.

The Fear and Greed Index has climbed from extreme fear to 21 as of December 7, indicating that sentiment is starting to normalize. Bitcoin, which briefly pulled back to the $80,000 area last month, has returned to the $90,000 range, with traders closely watching for a potential push toward $100,000.

With confidence gradually returning, many investors are now searching for the best crypto presales to buy before the market enters a stronger bullish phase.

Low cap presale projects with real token mechanics and active communities often gain traction during moments like these, especially as the year-end rally approaches.

Source – 99Bitcoins YouTube Channel

Best Crypto Presales: 3 Projects to Watch Through 2026

The current wave of investor interest is being driven by projects that are actually doing something different, and Bitcoin Hyper, Pepenode, and Maxi Doge fall into that category.

Each one brings a distinct mechanism that shapes how value flows within its ecosystem, giving investors clear reasons to pay attention during this presale cycle.

Bitcoin Hyper (HYPER)

While Bitcoin has recently experienced stagnation, certain projects in its ecosystem are showing significant momentum, and Bitcoin Hyper is among the most notable.

Designed as a Layer 2 solution, the project aims to enhance Bitcoin’s capabilities by maintaining its strong security while dramatically increasing transaction speed.

This approach allows the network to handle a higher volume of transactions without compromising reliability. As a result, Bitcoin Hyper plays a practical role in improving how users interact with Bitcoin during periods of high network activity.

The project has already attracted substantial funding, hitting a new milestone of $29 million. This reflects strong confidence from investors, including “whales,” with individual purchases ranging from $500,000 to $830,000, demonstrating its appeal even during periods of market weakness.

At the center of the ecosystem is the HYPER token, which provides a range of utilities. Token holders benefit from reduced transaction fees on the Layer 2 network, governance voting rights, and staking rewards of up to 40%, giving the token functional value beyond mere speculation.

Analysts have observed that capital often moves toward promising Layer 2 or side projects when Bitcoin growth slows, and Bitcoin Hyper illustrates this trend.

The presale is currently open via the official website and Best Wallet, offering early access to investors interested in participating in the project’s development.

Visit Bitcoin Hyper

Maxi Doge (MAXI)

Dogecoin might be losing momentum, but the meme coin market is still moving fast. One of the projects attracting the most attention is Maxi Doge, which stands out because of its low starting valuation and a presale that has already raised over $4 million.

The excitement around Maxi Doge has been so strong that even a fake token appeared on the market and surged in price. This unusual reaction shows just how high the demand is for the real Maxi Doge, even during a broader market downturn.

What makes Maxi Doge unique is its high-energy, risk-forward approach. The coin is designed for extreme leverage trading, supporting up to 1000x, reflecting its “maximum exposure” concept.

It is also a community-driven, gamified experience. Maxi Doge rewards holders with dynamic APY staking, contests, partner events, and gamified tournaments that actively involve the community and encourage long-term engagement.

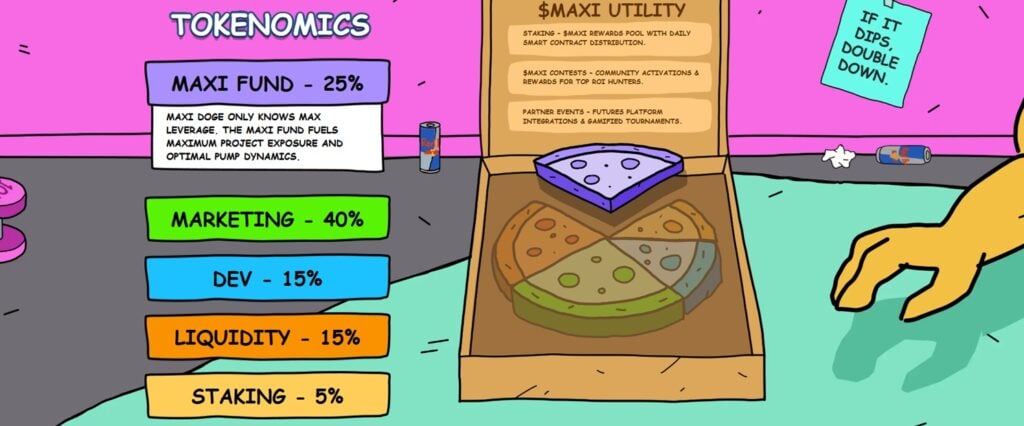

The tokenomics are structured to support growth and activity:

- 25% goes to the Maxi Fund

- 40% is dedicated to marketing campaigns to increase visibility across social channels

- 15% ensures liquidity for smoother trading

- 15% supports ongoing platform development

- 5% funds staking rewards

Every part of the ecosystem is set to boost activity, visibility, and community involvement.

Maxi Doge also nails branding and meme culture. Its mascot and playful visuals appeal to crypto fans and give it a viral edge. Security is powered by Web3 toolkit technology, and the presale is easy to join through popular wallets including Best Wallet.

With early adoption rising and a roadmap full of influencer campaigns, DEX and CEX listings, and platform integrations, Maxi Doge is shaping up to be more than a meme coin. It is a fast-paced, participatory crypto experience ready to ride the next wave of meme coin excitement.

Visit Maxi Doge

Pepenode (PEPENODE)

Amid recent market fluctuations, Pepenode is emerging as a distinctive Ethereum-based project that combines gamified mechanics with deflationary tokenomics and staking rewards.

At its core is a browser-based “mine-to-earn” game where users acquire virtual nodes, upgrade them to boost mining power, and collect rewards. Each action directly affects the token economy, creating a tangible connection between user participation and value growth.

A defining feature of Pepenode is its deflationary structure. 70% of tokens spent on node upgrades are immediately burned, reducing the circulating supply as the community actively engages with the platform.

At the same time, the staking system allows token holders to earn rewards during the presale phase, encouraging retention while reinforcing scarcity.

The presale has already raised over $2 million, demonstrating strong demand despite the broader market slowdown. With a current price of $0.0011825, early participants gain access at a level that maximizes potential upside as the project develops.

Pepenode’s combination of meme energy, gamified incentives, and strategic token mechanics creates measurable growth, linking community activity directly to token value and giving it an edge over conventional meme or GameFi projects.

Visit Pepenode

Conclusion

Meme coins are no longer just playful tokens, they’re becoming serious contenders in the crypto space.

With investor sentiment improving, capital is starting to move back into projects that combine creative appeal with tangible utility and technological innovation.

Among these, a handful of coins are already turning heads, not because of hype alone, but because they’re building ecosystems, offering real staking rewards, and enabling practical use cases that go beyond speculation.

This is a moment for investors to think strategically. Understanding how these projects operate, how their communities are growing, and how their tokens can be used in real applications reveals where the market’s next growth waves are likely to come from.

With presales open through official channels and trusted wallets, those who act now have a front-row seat to some of the most exciting opportunities in crypto today.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

Over 80% of 135 Ethereum L2s record below 1 user operation per second