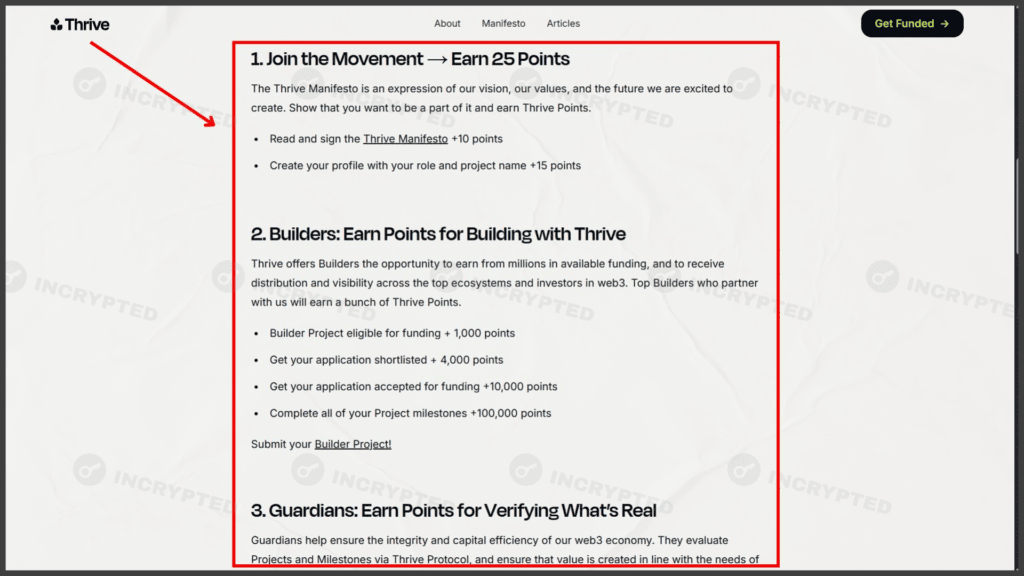

At the time of writing, there is not much activity, and there is no information about investments. Points can be earned at three levels: as an ambassador, as a regular user, and as a project builder. We are also waiting for the launch of the main points program for everyone.

Follow the project on social media so you don’t miss any important updates.

Highlights:

- we perform tasks;

- farm points.

If you have any questions during the activities, you can ask them in our Telegram chat.

Useful links: Website | X

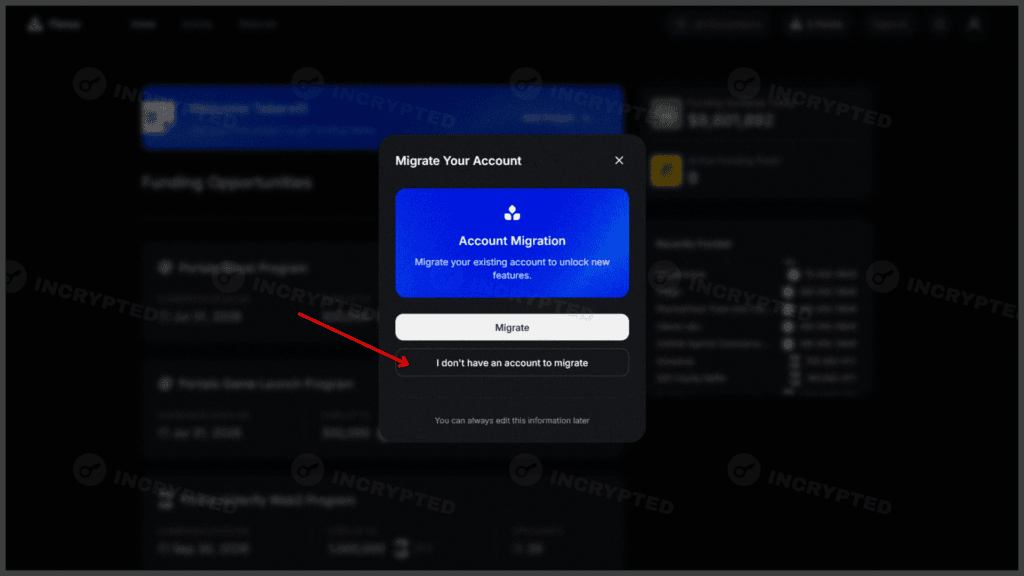

We are going through registration. Data: Thrive.

We are going through registration. Data: Thrive.

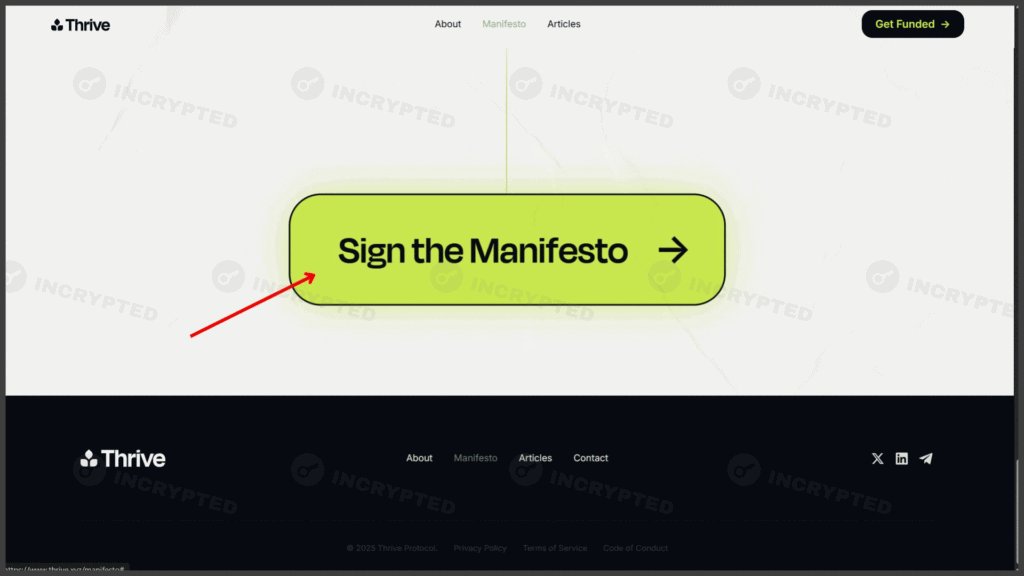

Signing the manifesto. Data: Thrive.

Signing the manifesto. Data: Thrive.

Additional tasks. Data: Thrive.

Additional tasks. Data: Thrive.