Best Meme Coins to Buy – Fartcoin Price Prediction

The market drops about 1% on the day. Fear and greed sits at 25, altcoin season index sits at 22, and the crypto RSI sits around 46. These readings show caution but not heavy fear.

Bitcoin trades in the green on the hourly chart. Ethereum turned green earlier today and still holds gains for the week. Large altcoins now start to recover, and this shift usually pushes traders toward smaller speculative plays. In this setup, Fartcoin stands out as one of the top gainers before cooling off.

The token jumped more than 5% for a short time before pulling back about 2%. Even with the dip, interest keeps rising as traders search for assets that can outperform during uncertain conditions.

Fartcoin now sits among the few meme coins showing real momentum, and many traders wonder if a bigger move is starting.

While FARTCOIN exemplifies the power of pure viral hype, the market is also rotating toward projects that blend meme narratives with real utility.

This shift is creating a new category of assets often seen as the best meme coins to buy for long-term growth. Bitcoin Hyper (HYPER) stands as the leading example in this space.

Source – 99Bitcoins YouTube Channel

Fartcoin Price Prediction

Recent headlines show growing momentum around Fartcoin. Articles like “Fartcoin (FARTCOIN) To Surge Ahead? Key Harmonic Pattern Signals Potential Upside Move” and “Fartcoin Price Smashes 129-Day Barrier After Surging 100% From Lows” highlight renewed interest.

Other updates mention an 11% jump during the latest push, which helped Fartcoin climb back into the list of most-viewed meme coins. Today it ranks as the fifth most-visited meme token, a sign that attention is heating up again.

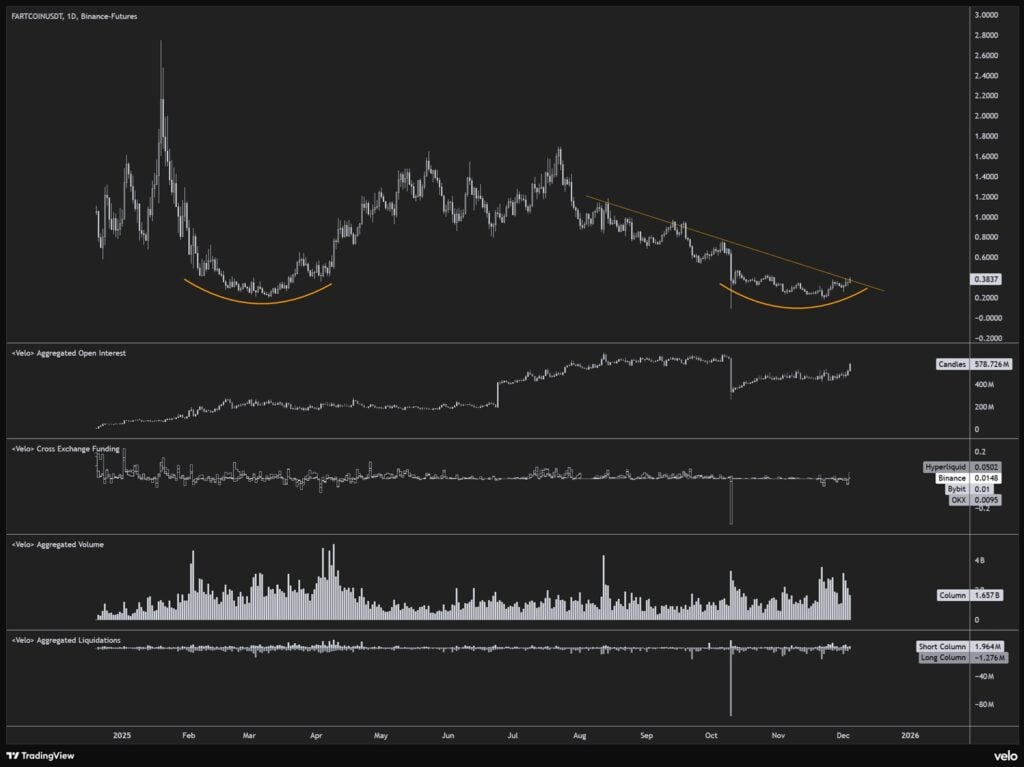

Source – Byzantine General via X

The Solana-based meme coin trades around $0.37 on early December 5, up roughly 10-12% in the past 24 hours and more than 100% from its November lows near $0.17-$0.24. This stands out compared to Bitcoin’s 1.5% drop to $92,000 and Ethereum’s 2% slip to $3,100.

Analysts point to rising open interest, trading volume above $240 million, and chart patterns that resemble earlier rallies. These signals place Fartcoin on many traders’ watchlists despite leverage risks and high volatility.

The chart now shows a basing pattern, a structure that often forms before a strong pump. Earlier this week, Fartcoin gained more than 17%, making it the most bought token of the week according to Stalkchain. That move added more fuel to the bullish outlook.

Community watchers also report rising excitement. A post on the Front Runners X page suggested Fartcoin may be setting up for a push toward new all-time highs. Onchain analysis revealed more key activity.

A major wallet tracker on X spotted three new wallets accumulating a few percent of the supply over the last one to three days. These wallets now join the top 5% group already under watch.

This trend makes some traders believe large holders may be preparing for a bigger move. Fresh accumulation from new whales often shows up right before momentum shifts.

Fartcoin Pumps as Bitcoin Hyper Surges To $29M in Presale Momentum

Money keeps moving through the crypto market, and Bitcoin Hyper is one of the projects gaining strong attention. This Layer 2 network raises funds very quickly and now sits at the $29 million mark. If this pace continues, it could climb even higher soon.

Bitcoin Hyper works as a Bitcoin Layer 2 that gives users Solana-level speed without leaving the Bitcoin ecosystem. In simple terms, it offers near-instant confirmations, very low fees, and smart contracts powered by the SVM, while keeping $BTC as the main asset used across the network.

The idea is easy to understand. Users get fast payments in wrapped $BTC, smooth swaps, lending, staking, NFTs, and gaming apps, all running on a fast execution layer instead of the slow and crowded Bitcoin mainnet.

Momentum continues to grow. Whales have started buying too, including one investor who picked up more than $500K worth of $HYPER. Moves like this show they understand how important $HYPER could become in the ecosystem.

The presale growth shows the same trend. It has raised $29 million with tokens priced at $0.013375, placing $HYPER among the best meme coins to buy right now. The 40% staking APY also encourages holders to keep their tokens locked for the long term.

Anyone who wants $HYPER while the presale is still open can visit the Bitcoin Hyper website and buy using SOL, ETH, USDT, USDC, BNB, or a credit card. Bitcoin Hyper recommends using Best Wallet, widely seen as one of the top crypto and Bitcoin wallets available.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Wormhole’s W token enters ‘value accrual’ phase with strategic reserve

Wall Street sets AMD stock price target for next 12 months