Crypto market plummets after US attacks Iran nuclear sites

The crypto market turned red on Saturday and Sunday as geopolitical tensions spiked following President Donald Trump’s order to bomb Iran’s nuclear sites.

The U.S. joined Israel in launching strikes on Iran early Sunday, targeting three key nuclear sites in an operation aimed at crippling Iran’s nuclear enrichment capabilities.

Trump declared the mission a success, claiming the facilities were “completely and totally obliterated.” Iran vowed to defend itself, according to the New York Times.

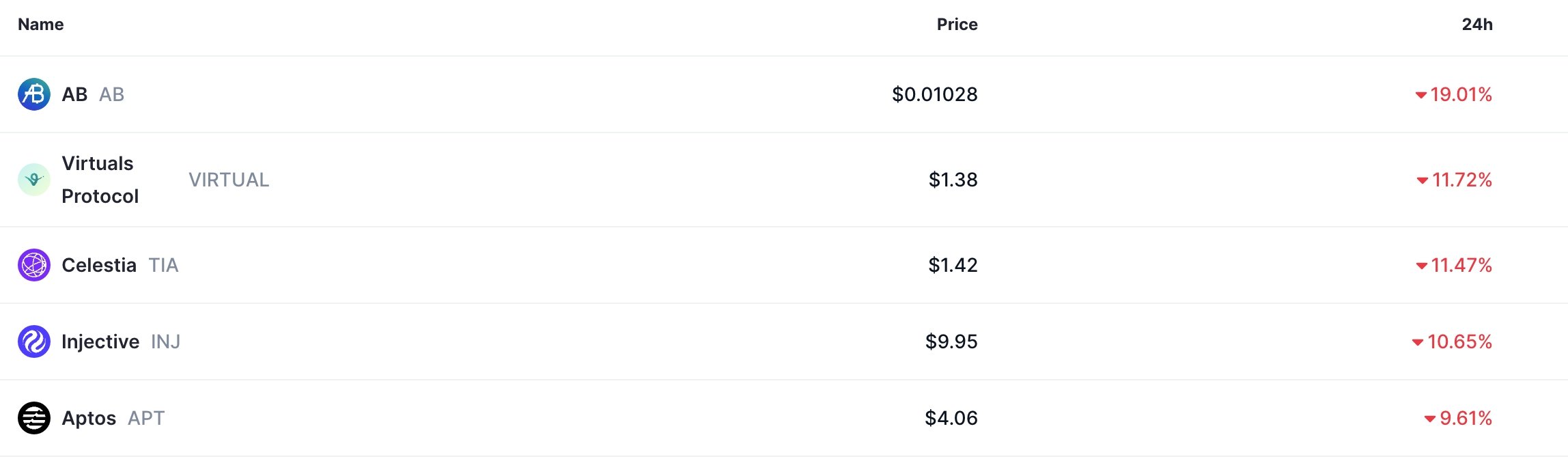

At last check on Sunday, Bitcoin (BTC) price dropped below $103,000, while top altcoins like Virtuals Protocol (VIRTUAL), Celestia (TIA), AB (AB), and Aptos (APT) plunged by over 9% in the last 24 hours.

The total market capitalization of all cryptocurrencies tracked by CMC plunged by 1.65% in the last 24 hours to $3.15 trillion. Similarly, CoinGlass data shows that the sell-off triggered a 38% surge in liquidations to over $682 million.

Crypto market crashed as geopolitical risks rose

Bitcoin and most altcoins plunged after the U.S. launched a major bomb in Iran targeting three nuclear sites. Trump’s goal was to destroy Iran’s nuclear capabilities as its missile exchange with Israel continues.

These assets likely dropped for two main reasons. First, they dropped as investors embraced a risk-off sentiment following this attack. Historically, risky assets like stocks and cryptocurrencies retreat after a major black swan event.

| CRYPTOCURRENCY | PRICE | 7-DAY +/- |

| Bitcoin (BTC) | $102,666 | -2.4% |

| Ethereum (ETH) | $2,273.95 | -9.7% |

| Solana (SOL) | $133.11 | -8.7% |

| XRP (XRP) | $2.03 | -6.1% |

| Dogecoin (DOGE) | $0.1557 | -10.8% |

| BNB (BNB) | $630 | -2.8% |

For example, stocks and crypto fell in April after Trump launched retaliatory tariffs. They also fell in March 2020 after the COVID pandemic started, and in February 2022 after Russia invaded Ukraine. In a note to Bloomberg, Hanain Malik of Tellimer said:

Crisis in Iran may lead to higher inflation

The other main reason the crypto market crashed is that the Middle Eastern crisis could lead to higher crude oil and shipping prices. Brent and West Texas Intermediate oil benchmarks have already jumped by over 32% from the year-to-date low, and analysts anticipate rising prices. Shipping costs have also jumped.

The implication is that consumer inflation in the U.S. may keep rising, which will prevent the Federal Reserve from cutting interest rates.

In its meeting last week, the bank left interest rates unchanged between 4.25% and 4.50%. It hinted that it will deliver two cuts this year and four in 2026 and 2027. Bitcoin and other altcoins do well when the Fed is cutting interest rates.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

The Next Bitcoin Story Of 2025