Tokenized stock market dominated by only two players, study reveals

The tokenized stock market is expanding fast, yet nearly all activity is concentrated in Backed and Ondo Global Markets, which dominate trading with popular U.S. tech shares and ETFs. While most offerings are synthetic, platforms exploring true ownership are emerging.

- Tokenized stocks are growing quickly, but the market is almost entirely dominated by Backed and Ondo Global Markets.

- Most of these tokenized stocks are synthetic, tracking popular U.S. tech shares and ETFs on Ethereum and Solana, while only a few platforms, like Superstate Opening Bell, are experimenting with giving investors true ownership.

- The rapid growth shows blockchain can attract investors fast, but the market remains highly concentrated, and questions about legal status, custody, and pricing persist.

The market for tokenized stocks is growing rapidly, yet almost all of it is dominated by just two companies, with Animoca Brands Research reporting that Backed and Ondo Global Markets together account for 95% of the total market value as of September, a level of concentration that is hard to ignore.

Tokenized stocks are digital versions of regular company shares. They let people trade stocks anytime on blockchain platforms like Ethereum and Solana. It makes investing more flexible and accessible.

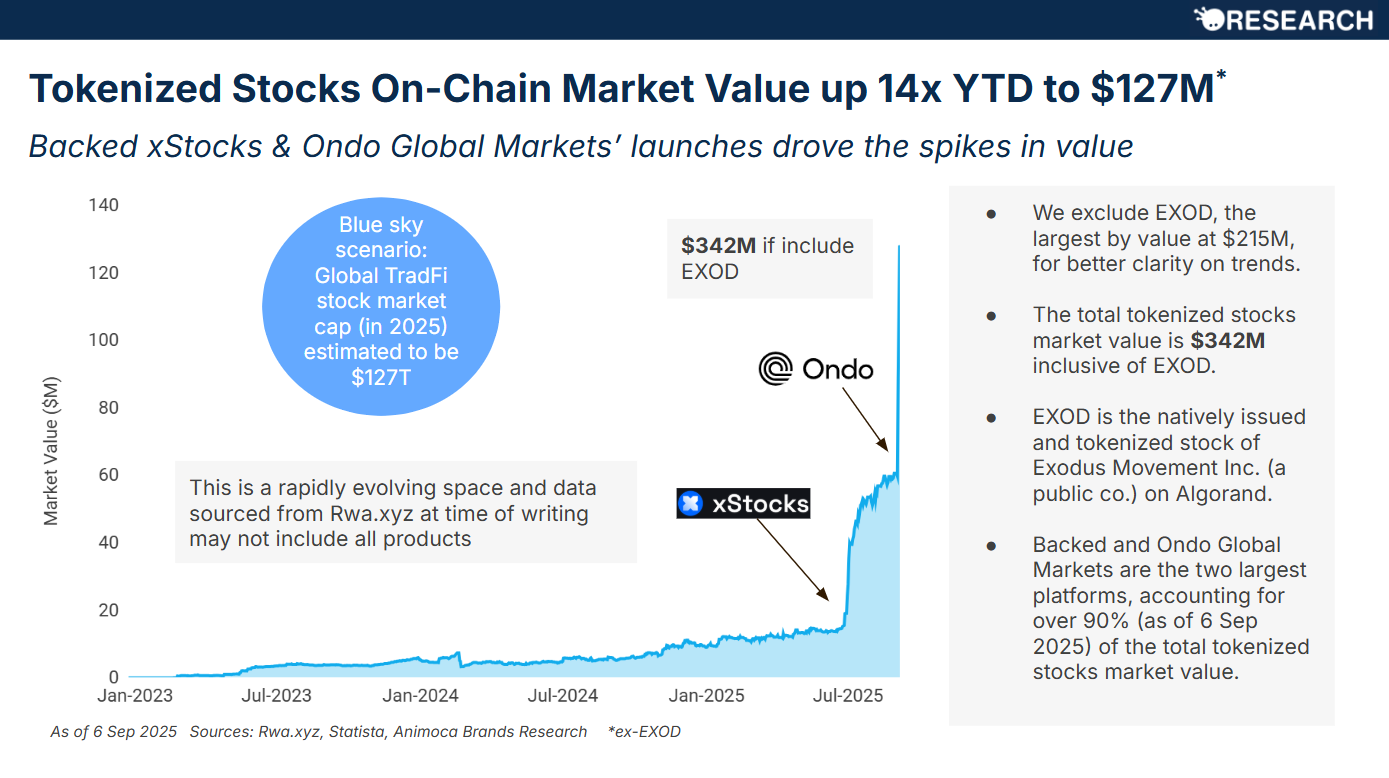

According to Animoca Brands’ research called “State of Tokenized Stocks,” the on-chain market value of tokenized stocks, excluding EXOD, is about $127 million, which is 14 times higher than earlier this year. Including EXOD, which represents tokenized shares of Exodus Movement Inc., the total rises to $342 million.

The growth, according to the report, mostly comes from Backed’s xStocks and Ondo Global Markets.

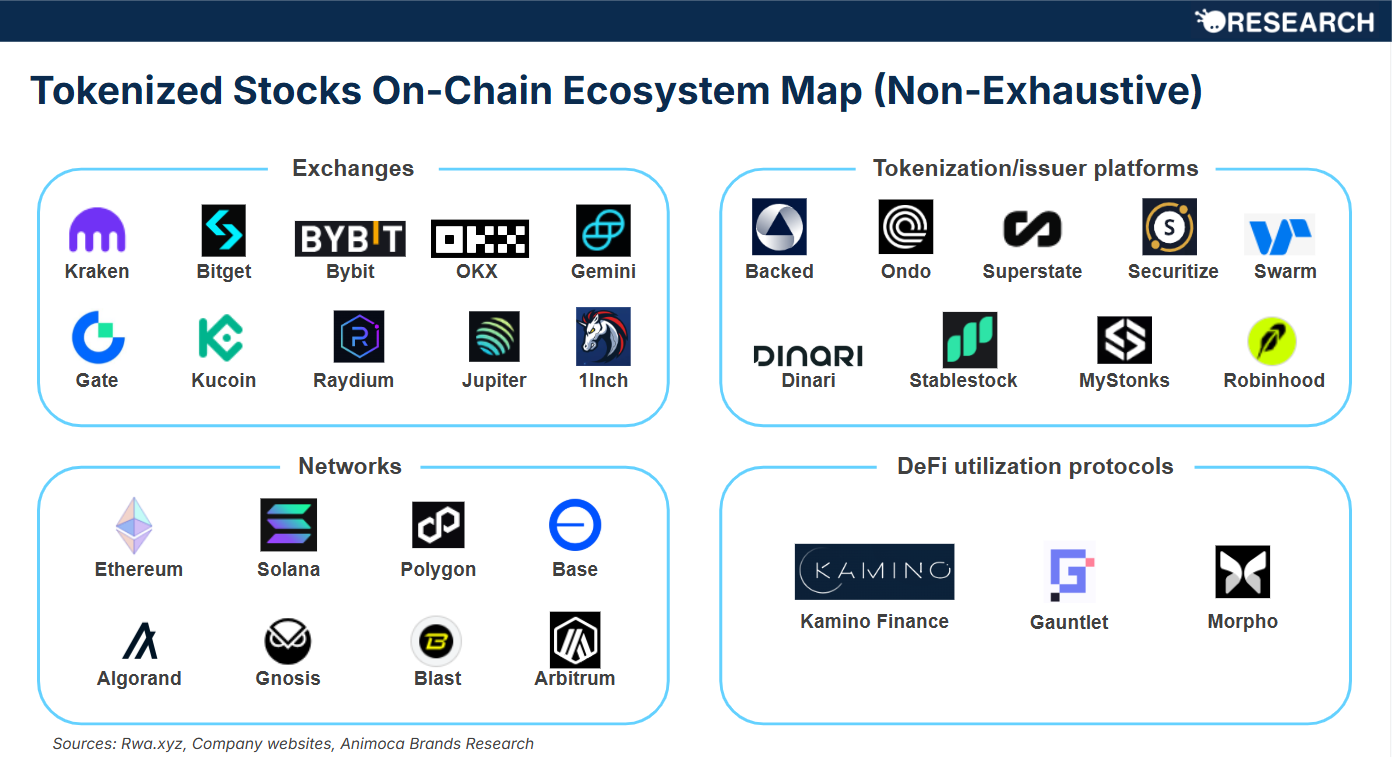

Backed and Ondo Global Markets have focused on a handful of popular U.S. tech stocks and broad market ETFs like the S&P 500 and Nasdaq 100. By sticking to well-known assets, they make it easy for investors to understand and trade these tokens, the analysts explain, noting that most tokenized stocks are currently traded on Ethereum and Solana. As of press time, there are two main ways to create tokenized stocks:

- Synthetic structure: This model tracks the price of a stock but doesn’t give the investor actual ownership rights. Backed and Ondo Global Markets use this approach, allowing investors to see the stock move in value without handling the underlying share directly.

- Native issuance: This type gives investors true ownership rights, similar to holding the actual stock. Superstate Opening Bell is trying this model, starting with Galaxy Digital’s GLXY stock. As Animoca Brands Research explains, Backed and Ondo Global Markets are “key tokenization platforms/issuers using synthetic structures, while Superstate Opening Bell is exploring native issuance, starting with Galaxy stock.”

Backed and Ondo Global Markets have stayed ahead because they were first to launch, Animoca says, adding that they picked popular assets and built platforms that are simple to use. But their dominance also shows that the market is still very concentrated. As Animoca notes, together both Backed and Ondo “account for 95% of the market value.” While other platforms are trying to enter, right now, they make up only a small part of the market.

The growth of tokenized stocks also shows how new blockchain products can attract investors quickly. Backed’s xStocks and Ondo Global Markets provide exposure to widely recognized companies, which makes it easier for investors to try blockchain trading without taking on too much risk. But it’s not the same thing as native issuance.

Superstate Opening Bell is experimenting with giving investors actual ownership rights, with the report saying this approach might eventually unlock investors ‘true ownership rights.’

Pre-IPO stocks on Solana

Animoca Brands’ report mainly focuses on public stocks, leaving out private companies or other financial products. That matters because other projects are pushing private shares into retail rails. For example, decentralized trading platform Jupiter recently integrated tokenized pre-IPO stocks to its platform through a tie-up with PreStocksFi, allowing users to trade tokens tied to names like SpaceX, OpenAI, and Anthropic on Solana.

Those tokens are issuer-created tradable claims rather than literal company certificates, and some large holders can request redemption for (USDC) under certain conditions. Redemptions usually require KYC and are handled off-chain through the issuer or an SPV, and liquidity is provided on DEXes like Jupiter and Raydium, so retail traders can buy and sell around the clock.

While that setup works in practice, it also raises concrete questions about legal status, custody, and how prices are set when there is no public market for the underlying shares.

You May Also Like

Top NYC Book Publishing Companies

Sensorion Announces its Participation in the Association for Research in Otolaryngology ARO 49th Annual Midwinter Meeting