Sui Blockchain Explained (2025): Move Language, High-Speed Layer-1 & The Future of Web3

Table of Contents

Table of Contents

- What is Sui? The Silicon Valley Blockchain Revolution

- From Facebook’s Crypto Ruins: The Birth of Sui

- Move Language & Performance: Why Sui is Different

- Ecosystem & Partnerships: Where Sui Stands Today

- Real-World Applications: DeFi, NFTs & Gaming

- SUI Tokenomics Explained

- Sui in 2025: Growth, Challenges & Milestones

- FAQ: 10 Unanswered Questions About Sui

What is Sui? The Silicon Valley Blockchain Revolution

What is Sui? The Silicon Valley Blockchain Revolution

While Ethereum struggles with scalability, a new blockchain from Silicon Valley promises a revolution: Can Sui deliver what others only claim?

From Facebook’s Crypto Ruins: The Birth of Sui

From Facebook’s Crypto Ruins: The Birth of Sui

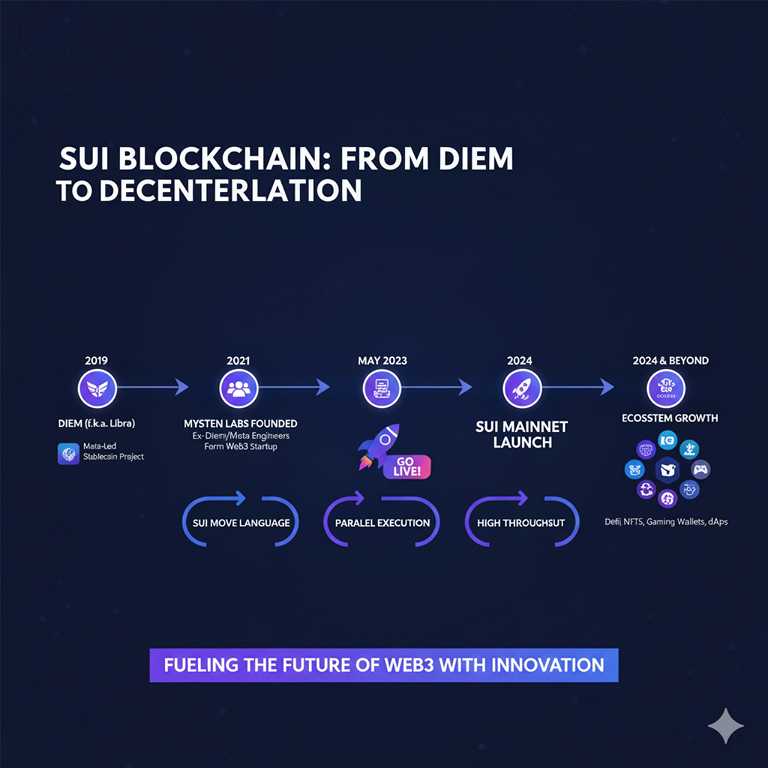

Sui was born in 2022 when former engineers from Meta’s failed Diem project founded Mysten Labs. Drawing on years of experience in high-performance systems, they launched Sui’s mainnet in May 2023 with backing from a16z and Coinbase Ventures. The vision: a blockchain for mass adoption, especially in gaming, NFTs, and DeFi, but without the regulatory baggage that doomed Facebook’s Libra.

Move Language & Performance: Why Sui is Different

Move Language & Performance: Why Sui is Different

At the heart of Sui lies the Move programming language, developed for Diem but now fully unleashed. Unlike Ethereum’s Solidity, Move treats digital assets as independent objects with their own properties. This architecture allows Sui to theoretically handle 100,000+ TPS with <400ms latency, dwarfing Ethereum’s 15 TPS.

| Blockchain | Transactions per Second (TPS) | Latency |

|---|---|---|

| Ethereum (Mainnet) | ~15 | >10 seconds |

| Solana | ~65,000 (theoretical) | 400–600ms |

| Sui | 100,000+ | <400ms |

Ecosystem & Partnerships: Where Sui Stands Today

Ecosystem & Partnerships: Where Sui Stands Today

The strength of a blockchain lies in its ecosystem. In DeFi, Cetus Protocol has emerged as Sui’s leading DEX, while Scallop provides lending and borrowing infrastructure. In NFTs and gaming, BlueMove and OriginX show promise, though liquidity still trails Solana and Avalanche.

Real-World Applications: DeFi, NFTs & Gaming

Real-World Applications: DeFi, NFTs & Gaming

Sui demonstrates strengths beyond theory:

- DeFi: Near-instant token swaps, low slippage, minimal fees.

- NFTs: Affordable minting for small creators, unlike Ethereum’s gas-heavy model.

- Gaming: Cost-effective, high-frequency asset transactions for in-game economies.

- Micropayments: Content creators can sell digital goods for cents—unviable on Ethereum.

SUI Tokenomics Explained

SUI Tokenomics Explained

Sui has a fixed max supply of 10 billion SUI, unlike Ethereum’s theoretically unlimited supply. Token utilities include:

- Transaction fees

- Staking for validator security

- Governance rights

| Utility | Function | Current Impact |

|---|---|---|

| Fees | Keep the network running | Ultra-low compared to Ethereum |

| Staking | Validators secure the network | Rewards ~3–5% annually |

| Governance | Protocol upgrade voting | Growing role in decision-making |

Sui in 2025: Growth, Challenges & Milestones

Sui in 2025: Growth, Challenges & Milestones

2025 brought new gaming partnerships (often under NDA), steady DeFi growth, and improved NFT marketplace activity. Network upgrades further reduced latency, underscoring Sui’s tech advantage. Yet, mass adoption remains elusive, with active wallets and daily transactions still below major competitors.

FAQ: 10 Unanswered Questions About Sui

FAQ: 10 Unanswered Questions About Sui

]]>You May Also Like

Crucial Fed Rate Cut: October Probability Surges to 94%

USD/INR edges lower as Indian Rupee gains on improving equity inflows