Hypurr NFT: A $60,000 Community Identity Symbol, Just Click and Get It?

By Alex Liu, Foresight News

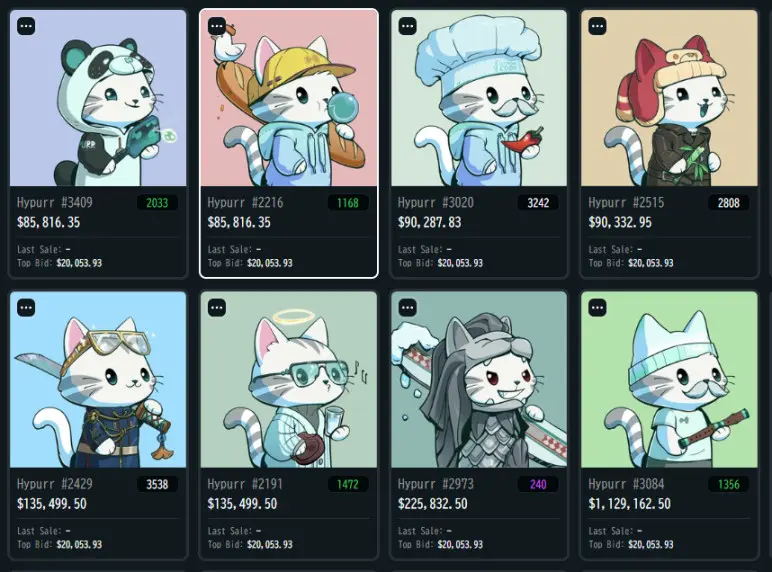

Hyper Foundation (Hyperliquid Foundation) announced in the early morning of September 29 that it had completed the deployment and distribution of Hypurr NFT. The floor price of this NFT on Opensea once reached US$80,000, and is currently still above 1,400 HYPEs, with a value of over US$60,000, or RMB 400,000.

Where does this NFT come from, and why is it valuable? It's said that the way to get it is through "click and go" during an airdrop.

Hypurr NFT: Hyperliquid’s “Community Memorial”

In the Web3 world, many projects use NFTs, airdrops, and other methods to connect with early-stage communities and enhance a sense of belonging. The Hypurr NFT is a community-building NFT launched by Hyperliquid. It's not a purely utility-oriented NFT, nor is it a financial product with promised returns. Instead, it's more of a symbol, identity, and cultural icon.

Background and Initial Distribution: Who Gets the Hypurr NFT?

Hyperliquid and HyperEVM

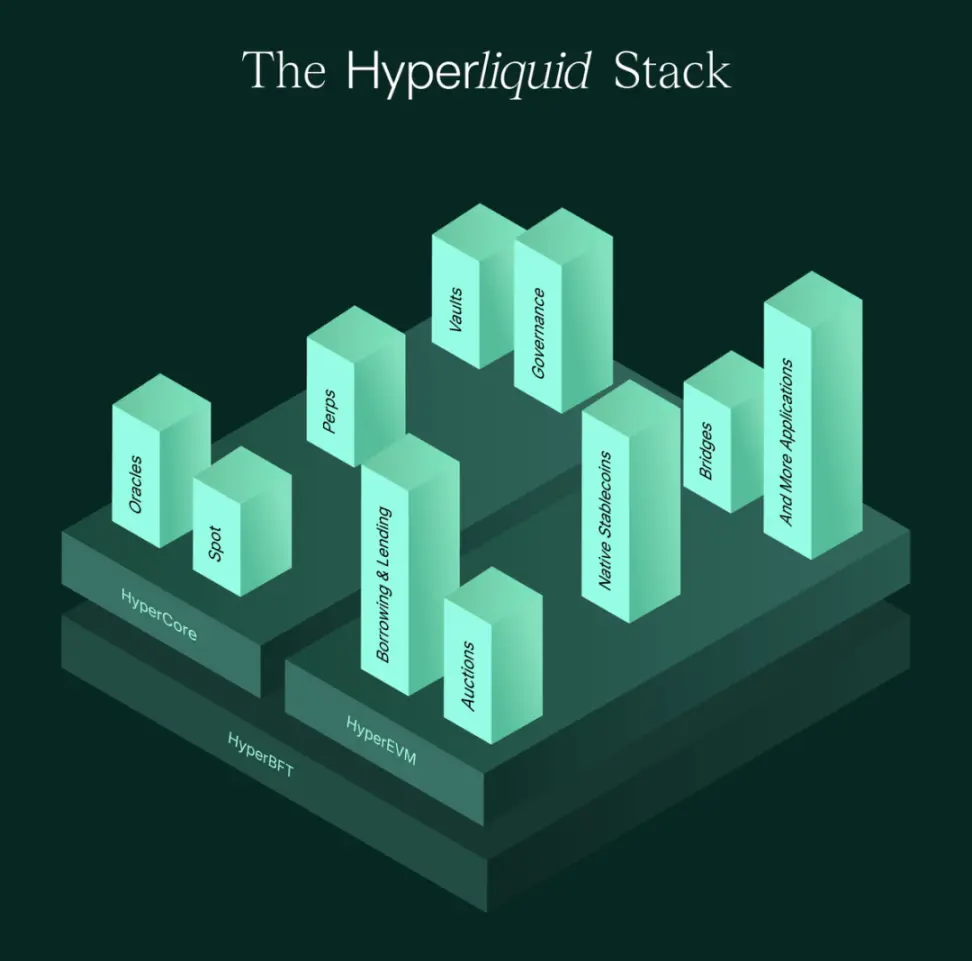

To understand Hypurr NFTs, you first need to understand the underlying network architecture. Hyperliquid is a Layer 1 network centered around decentralized trading, aiming to enable efficient on-chain functionality for trading, margin settlement, and order matching. Its consensus mechanism, HyperBFT, is fundamental to Hyperliquid's competitiveness in high-frequency trading and low-latency scenarios.

HyperEVM is part of the Hyperliquid architecture: it's not a standalone EVM chain, but rather a channel mechanism that allows developers to reliably read L1 state and initiate operations on core modules on the chain. This means there's bidirectional interaction between HyperEVM and HyperCore (Hyperliquid's foundational state layer).

Contracts on the HyperEVM can read L1 state (via read precompiles) and initiate operations on HyperCore via CoreWriter, establishing a linkage between the two layers. This design allows DeFi applications developed on the EVM layer to directly connect to Hyperliquid's liquidity foundation.

The design of Hypurr NFT was born on this infrastructure. It is not an independent project, but a community commemorative plan within the Hyperliquid framework.

How to obtain: Genesis Event and recognized distribution

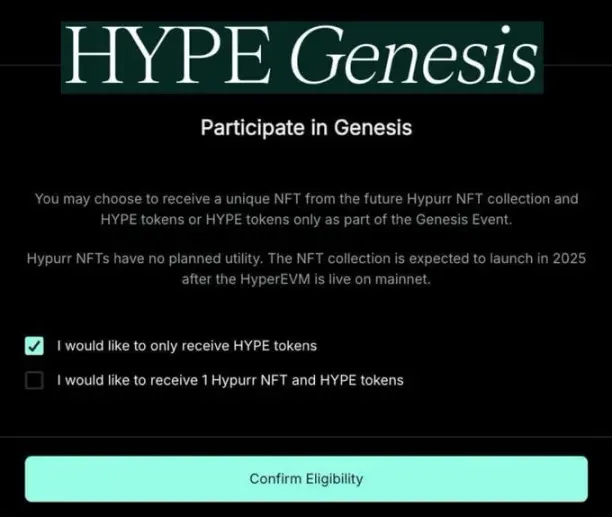

The Hypurr NFT will be distributed alongside Hyperliquid's Genesis Event in November 2024. According to the Hyper Foundation, "Participants will have the option to receive a Hypurr NFT as a commemorative gift after the HyperEVM launch."

In fact, this option was only available to the top 5,000 players who reached the Platinum rank during Hyperliquid's Season 1. The choice between "receive tokens only" and "receive tokens and NFTs" certainly confused overly suspicious participants. The NFT, valued at 400,000 yuan, wasn't a "click and you're gone" offer, but rather a "don't click and you're gone" offer.

In addition, the Hyper Foundation conducted a risk assessment on participants and used cluster analysis to limit a single address or user from obtaining too many NFTs to prevent sybil attacks.

Page Note: Hypurr NFT has no planned empowerments

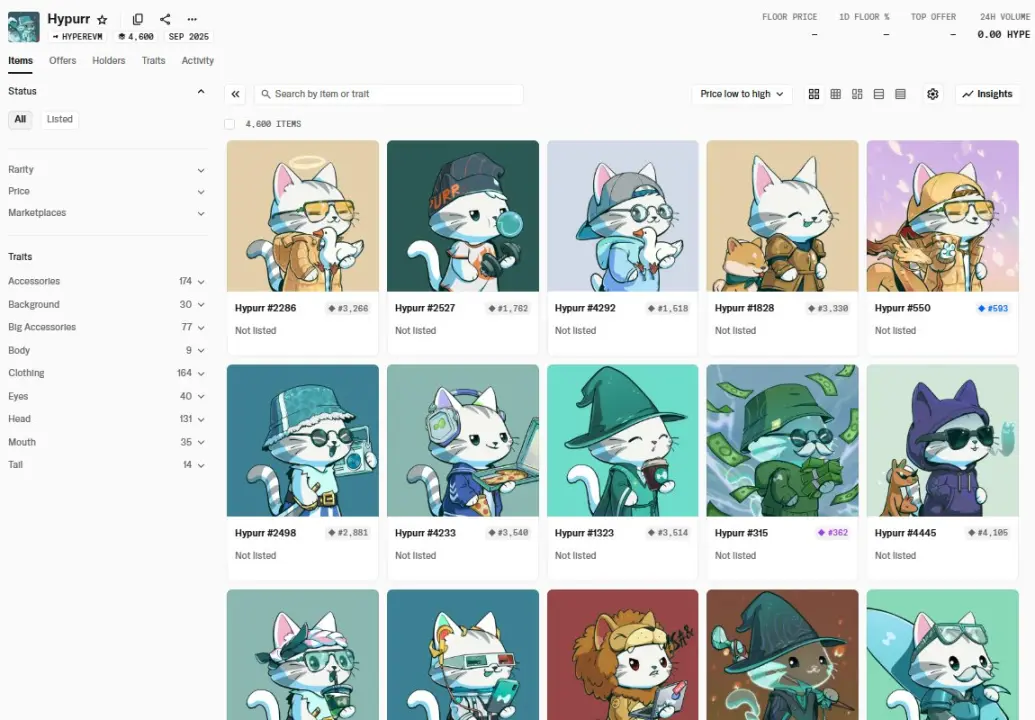

In terms of total quantity, the Hypurr NFT collection has a total of 4,600 items, including:

- 4,313 allocated to eligible participants of the Genesis Event

- 144 are reserved for the Hyper Foundation itself

- 143 distributed to core contributors (including Hyperliquid Labs, NFT artists, and other early contributors)

Once the distribution is complete, the Hypurr NFT will enter circulation. The Hyper Foundation also emphasized in an official statement: "No additional user action is required. The NFT has been distributed."

Holder distribution and circulation

Currently, there are 4,031 Hypurr NFT holders, with a dispersion of approximately 87.6%. In other words, most NFTs are distributed across multiple addresses rather than being highly concentrated.

This distribution helps avoid extreme concentration and increases community participation, but it can also lead to dispersed liquidity: if some holders lock their positions for a long time or remain silent, active supply may be insufficient.

Design Intention and Potential Empowerment: Commemoration, Culture and the Future

Commemoration and community belonging

The primary purpose of Hypurr NFTs is to serve as a memento, a token of appreciation, a reward, and a symbol of recognition for the project's early supporters. Officially, it's "a token shared with those who believed in Hyperliquid early on and helped it grow." Community observations indicate that the ID of each NFT appears to correspond to its ranking on the Hyperliquid leaderboard, with NFTs with lower IDs being more rare.

The artistic design of each Hypurr NFT strives to reflect the diversity and personality of the community: different emotions, hobbies, tastes and "quirks" are portrayed in the graphic art and become part of the community's identity.

In this sense, holding Hypurr NFT may have symbolic identity value in the community context - a sign of "I am an early witness."

Future empowerment possibilities: No promises

While the agreement explicitly doesn't promise utility, it doesn't rule out the possibility of additional benefits being added to Hypurr NFTs in the future, either through third parties or within the ecosystem. The agreement states, "Hypurr NFTs may be associated with certain benefits, features, or capabilities, but these are not guaranteed by the agreement."

This frees up space for future community and ecosystem planning: for example, certain future events, airdrops, community governance, and interactive privileges may be prioritized based on Hypurr NFT holders. However, this will depend on the subsequent path forward. Currently, no publicly confirmed additional benefits have been announced.

Currently, the price of this NFT is high, and market sentiment is enthusiastic. Many people are buying it with the expectation of receiving the right to receive Hyperliquid's next quarterly airdrop. It's important to note that the official statement does not promise "airdrops" or other benefits, so be prepared to consider this NFT as a mere status symbol.

You May Also Like

Dramatic Spot Crypto ETF Outflows Rock US Market

Remittix Success Leads To Rewarding Presale Investors With 300% Bonus – Here’s How To Get Involved