Ethereum Gas Fees Drop To $0.18, But Meme Investors Eye A Token With Built-In Fraud Filters

Ethereum Gas Relief Brings Headlines, But Not Full Safety

Ethereum’s network has finally given users a break. Gas fees dropped to as low as $0.18, making transactions cheaper than they’ve been in years. For developers, DeFi traders, and NFT enthusiasts, this is welcome news. Lower fees mean more activity and fewer complaints about Ethereum’s high costs.

But there’s a catch. Even with fees this low, Ethereum still doesn’t solve one of crypto’s biggest problems: fraud and manipulation. The market is filled with scams, rug pulls, and meme tokens that disappear overnight. Cheaper fees don’t protect investors from losing money in projects that were never safe to begin with.

Ethereum Average Gas Price History Graph. Source: ycharts.com

Why Retail Traders Still Feel Vulnerable

Retail investors know the pattern all too well. They join a trending meme coin, only to watch whales pump and dump it within days. Some projects vanish with liquidity drained, leaving holders empty-handed. Ethereum’s lower costs make entry easier, but the risk of falling for scams remains just as high.

This is why meme investors are starting to look beyond transaction fees. They want a token that not only rides culture and virality but also has protections against fraud.

MAGAX Enters as a Meme Coin That Values Security

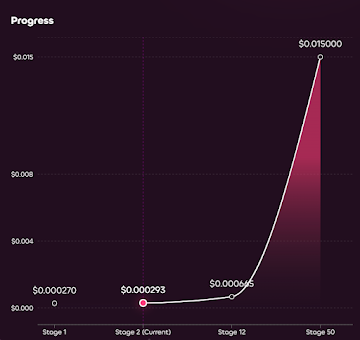

That’s where MAGAX is catching attention. Unlike most meme projects, MAGAX was designed with fraud filters and trust mechanisms built in. Currently in Stage 2 of its presale at $0.000293 per token, MAGAX has already separated itself from the rest of the meme pack by putting investor security first.

The team has partnered with CertiK for a professional audit, ensuring the project’s contracts are safe from backdoors or hidden risks. At a time when retail traders are tired of scams, this step has made MAGAX one of the most credible meme tokens entering the market in 2025.

Fraud Filters That Protect the Community

What does it mean when analysts call MAGAX a token with “fraud filters”? It means the project has systems and practices that block common threats to investors.

- Audit transparency: CertiK’s review builds confidence before launch.

- Presale fairness: Pricing is open and clear. Stage 2 investors know exactly what they are buying into.

- Anti-whale dynamics: The tokenomics prevent a handful of wallets from controlling the market.

- Community-driven model: Rewards go to participants, creators, and promoters, not just speculators.

By blending meme energy with structured safeguards, MAGAX gives retail investors something they rarely get: a fair shot at growth.

Meme-to-Earn: Culture With a Paycheck

Security is only half the story. MAGAX also introduces a Meme-to-Earn model, where creativity is rewarded with tokens. Community members who create and share viral content can earn directly. This turns meme culture into an economy, not just entertainment.

For Gen Z and younger investors who live online, this model resonates. They already create and spread memes daily—MAGAX simply gives them a way to get paid for it. It’s a viral loop that builds culture, community, and token adoption all at once.

Why Analysts See 1000%+ Potential

Analysts are tagging MAGAX as one of the few tokens in 2025 that could realistically deliver 1000%+ gains for early backers. The logic is simple: presales at under a cent provide huge upside if the token gains traction post-listing.

Unlike tokens that rely only on hype, MAGAX combines cultural power with investor protection. That balance makes it attractive to both risk-takers and cautious retail buyers.

Secure Your Spot Before Stage 2 Ends

Ethereum’s fee relief is great, but cheaper transactions don’t guarantee safer investments. MAGAX, on the other hand, combines low entry price, strong security, and viral energy into one package. It’s a project designed for retail investors who are tired of being last in line.

Stage 2 presale is almost sold out at $0.000293 per token. The next stage will raise prices, leaving latecomers with fewer tokens for the same money.

Don’t settle for hype without safety!

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post Ethereum Gas Fees Drop To $0.18, But Meme Investors Eye A Token With Built-In Fraud Filters appeared first on Live Bitcoin News.

You May Also Like

What Does Market Cap Really Mean in Crypto — and Why Australians Care

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected