Pi Network Price Forecast: PI risks further loss as bearish outlook persists

- Pi Network hit a record low on Monday, aligning with the community meetup in South Korea.

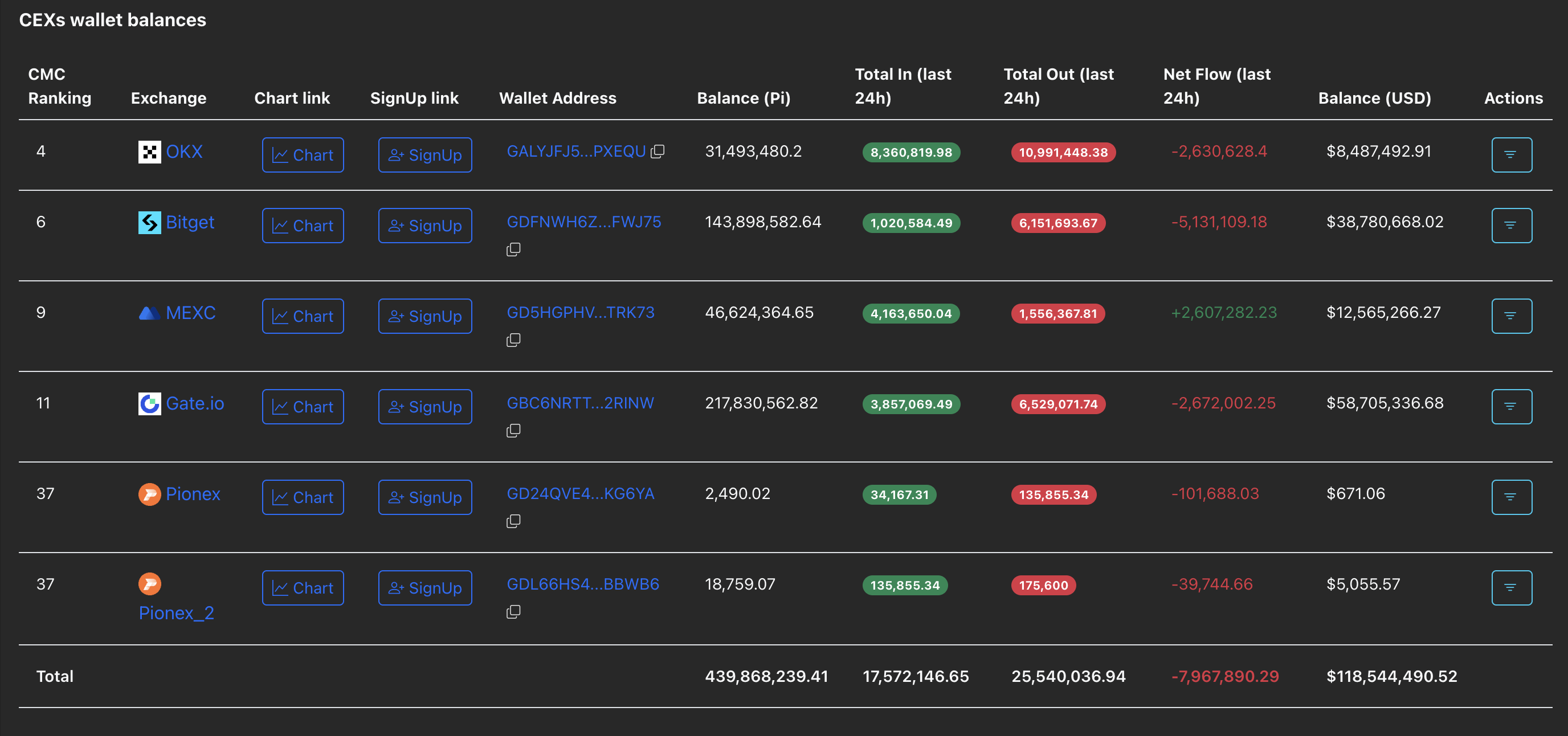

- CEXs' wallet reserves decline by nearly 8 million PI, indicating increased demand at lower prices.

- The technical outlook holds a bearish bias, hinting at further losses.

Pi Network (PI) edges lower by 5% at press time on Tuesday, advancing the 19% drop from the previous day. The sudden crash in Pi marks the failure of Pi Network founders to boost investor sentiment by visiting the Seoul community meetup on Monday. The technical outlook indicates further risk for PI as bearish momentum increases.

Still, the declining wallet reserve of Centralized Exchanges (CEXs) indicates that confident investors are buying the dip.

CEXs wallet reserve declines as PI rebounds from record low

Nicolas Kokkalis and Chengdiao Fan, founders of Pi Network, attended the community meetup in collaboration with Sign in Seoul on Monday. The founders shared a presentation on smart contract development on Pi Network, highlighting the upcoming protocol upgrade and AI-driven KYC features for faster user onboarding. However, the meetup failed to lift the investors' mood as the PI token reached a record low of $0.1842 on Monday, before closing the day at $0.2860.

Regardless of the recent crash, PiScan data shows a net outflow of 7.96 million PI tokens from CEXs' reserves over the last 24 hours, aligning with the rebound from the record low. This suggests that the confident investors are acquiring the mobile mining cryptocurrency at discounted prices.

CEXs wallet balances. Source: PiScan.

Bearish momentum supplements Pi Network’s downside risk

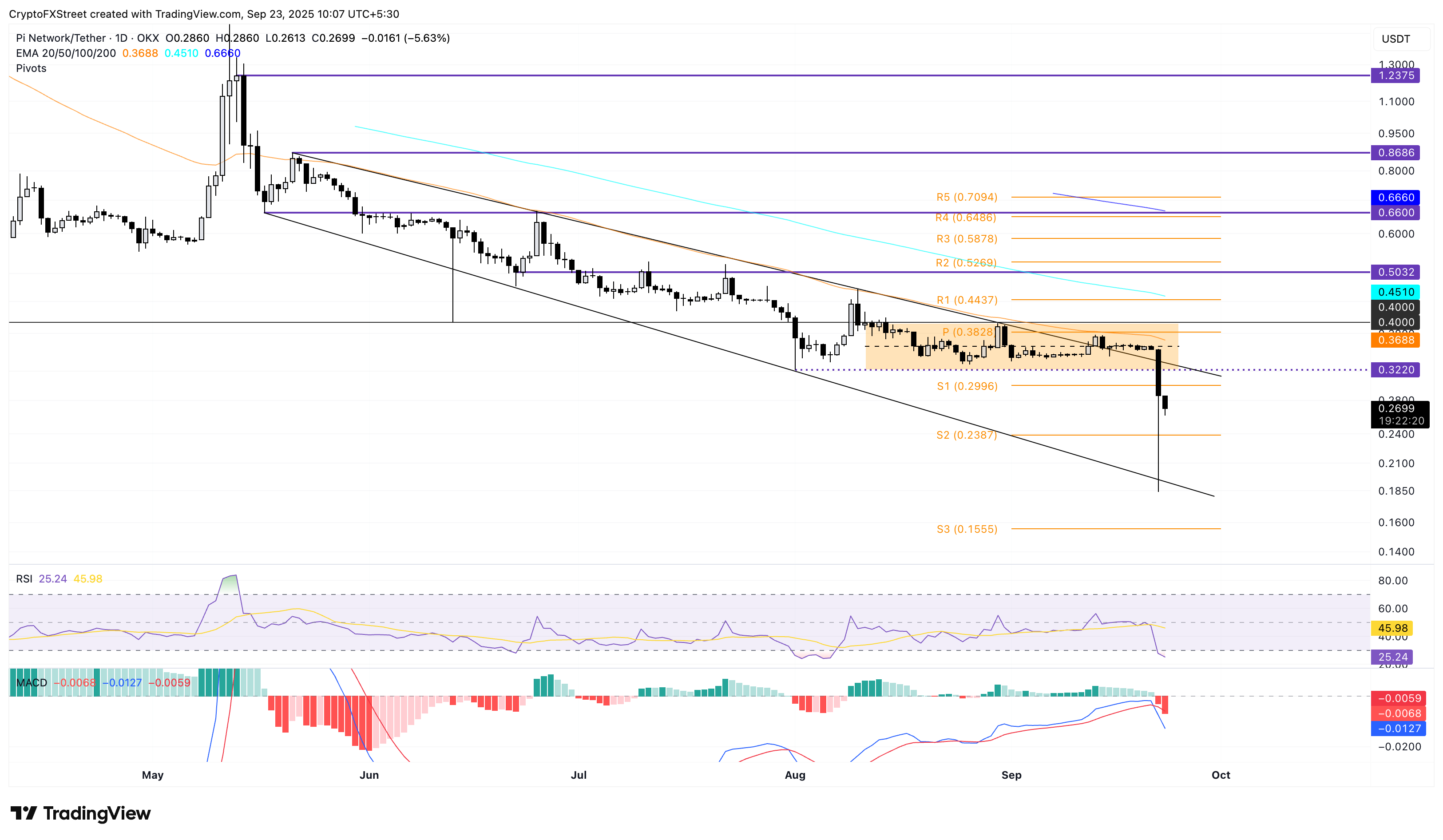

Pi Network trades around $0.2700 at the time of writing on Tuesday, extending the loss for the third straight day. The pullback invalidates the falling channel breakout and targets the S2 pivot level at $0.2387.

A decisive close below the all-time low of $0.1842 would confirm the breakdown of the falling channel pattern. This could result in a further decline to the S3 pivot level at $0.1555.

The momentum indicators on the daily chart suggest a sell-side dominance as the Relative Strength Index (RSI) at 25 drops into the oversold zone. Furthermore, the Moving Average Convergence Divergence (MACD) extends the declining trend after crossing below its signal line on Sunday. This indicates that the bearish momentum is rising.

PI/USDT daily price chart.

Looking up, a potential bounce back above the S1 pivot level, a support-turned resistance, at $0.2996, could challenge the overhead trendline at $0.3220. Beyond this, the centre pivot level $0.2838 could act as the next key resistance.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.

You May Also Like

VIRTUAL Bearish Analysis Feb 10

XRPL Developer Says 100% Taking Profits on XRP at $10, $27