Pi Network Price Forecast: PI consolidates while advancing Stellar protocol upgrade

- Pi Network’s declining trend takes a sideways shift in a consolidation range.

- Pi Network is progressing with the network upgrade to the Stellar protocol version 23.

- Technical indicators suggest a lack of momentum following a descending channel breakout.

Pi Network (PI) price sustains a steady move in a tight range above $0.3500 at press time on Thursday, extending the sideways trend. The consolidation phase marks an end to the prevailing downfall, which holds the fate of the upcoming trend. Meanwhile, Pi Network is progressing with the upgrade to the Stellar protocol version 23.

Pi Network Testnet 1 successfully shifts to version 23

Pi Network announced a successful protocol upgrade by shifting the Testnet 1 blockchain to the Stellar protocol version 23 from version 19. Following this, the core team will now focus on updating the Testnet 2 following the Mainnet upgrade.

The new upgraded version will bring smart contracts functionality, as previously mentioned by FXStreet. However, the community remains in the dark on the progress, while the core team has shared the possibility of planned network outages during the implementation.

The Testnet 1 shifts failed to uplift the investors' sentiment surrounding Pi Network, as PI remains in a steady state around $0.3500. Still, the upcoming upgrade to the Testnet 2 will mark a step closer to the Mainnet receiving smart contract features, which could act as a catalyst.

Pi Network’s channel breakout remains trapped in a range

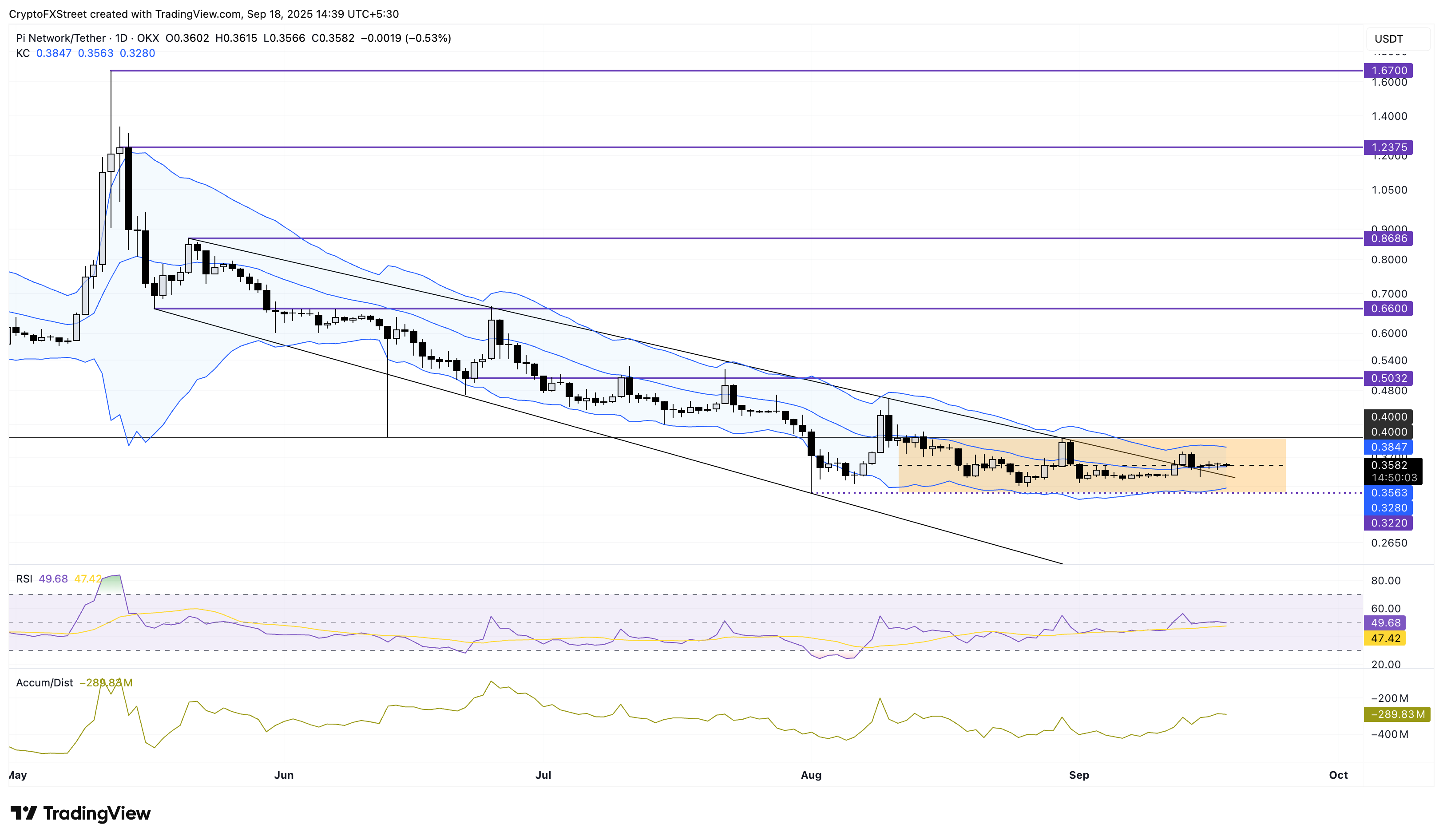

PI trades above $0.3500 at press time on Thursday, following three consecutive indecisive daily candles, which highlight the low volatility movement. The price action displays a range formed between the $0.4000 ceiling and the $0.3220 support floor.

Validating the consolidation, the converging Keltner channels shift from a downward trend, indicating lowered volatility. Furthermore, the Relative Strength Index (RSI) moves flat in the neutral zone at 49, which suggests a lack of momentum and indecisiveness among trades.

Still, the Accumulation/Distribution Line (ADL) increases to -289.83 million from -345 million on Sunday, which indicates a reduction in selling pressure.

Looking up, if PI sustains a daily close above the $0.4000 ceiling, it would mark an end to the streak of lower highs on the daily chart and the consolidation range breakout. More so, the mobile mining cryptocurrency could rebound to the $0.5032 level, last tested on July 22.

However, a drop below $0.3220 would invalidate the previous falling channel pattern breakout and result in a downside conclusion to the consolidation phase. This could extend the decline to the $0.3000 round figure.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.

You May Also Like

What Does Market Cap Really Mean in Crypto — and Why Australians Care

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected