UK Lawmakers Probe Stablecoins as Bank of England Warns of Deposit Drain Risk

A formal inquiry has been initiated by UK legislators into the expansion of stablecoins as regulators consider that the rapid adoption of these digital currencies would shift bank deposits and disrupt credit provision.

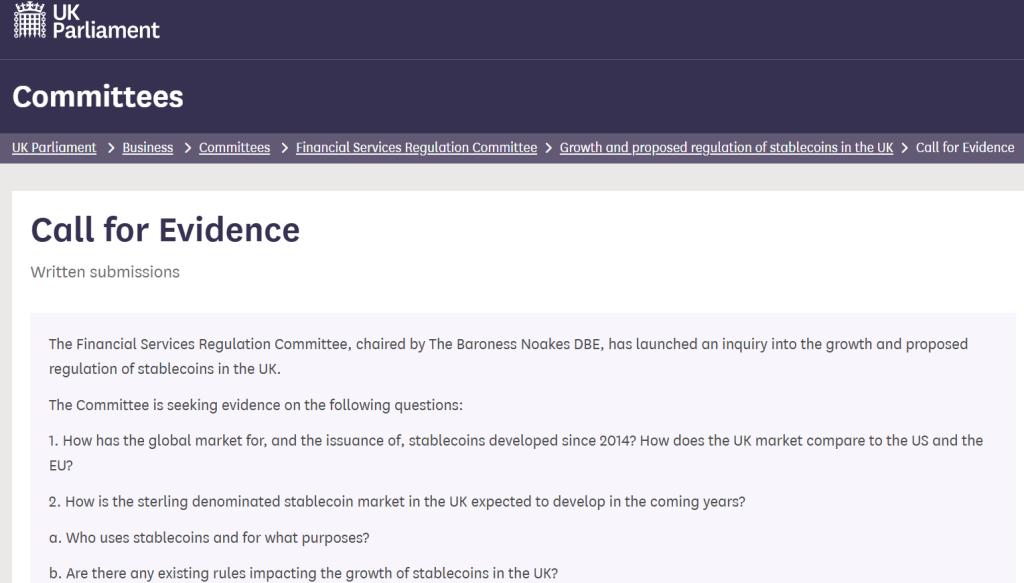

The House of Lords Financial Services Regulation Committee said in a January 29 statement that the investigation will determine the development of stablecoins in the UK and whether the proposed regulations by both the Bank of England and the Financial Conduct Authority strike a balance between innovation and financial stability.

Source: committees.parliament.uk

Source: committees.parliament.uk

The committee is also seeking written submissions of evidence by industry participants, experts, and the general populace until March 11, with oral evidence hearings to come after.

Stablecoins Under Review as UK Weighs Financial Stability Risks

The investigation will focus on sterling-denominated as well as currency-driven stablecoins, especially the U.S. dollar, which currently dominates stablecoin usage in the UK.

Lawmakers indicated that they were interested in knowing how the market had changed since the first stablecoins were introduced over a decade ago, how the UK would compare to the U.S. and the European Union, and what role the stablecoins would have in payments, savings, and financial markets in the future.

Baroness Noakes, the chair of the committee, added that the review will determine whether the proposals advanced by the Bank of England and the FCA will be considered as a series of proportionate and measured responses to the sector development issues.

The committee will also consider whether the development of stablecoins may be a challenge to the legislative objectives of UK regulators, such as financial stability, consumer protection, competition, and international competitiveness of the country as a financial center.

The parliamentary initiative follows as the Bank of England hastens the development of a specific regime of so-called systemic stablecoins, which are pound-denominated tokens used on a large scale either in payments or in settlement, which may have systemic risks.

Regulation of the stablecoins will become a key focus of the central bank in 2026, the policy work on tokenized collateral and the extension of its Digital Securities Sandbox, the central bank said.

Bank of England Moves Toward Stablecoin Rules by Year-End

Speaking at the Tokenisation Summit this week, Sasha Mills, the Bank of England’s executive director for financial market infrastructure, said the central bank is working jointly with the FCA to finalize a framework for systemic stablecoins by the end of the year.

Under the proposal, systemic issuers would hold deposit accounts at the Bank of England and could have access to a liquidity facility as a backstop.

Reserves would be backed by a mix of 60% short-term UK government bonds and 40% deposits at the central bank, with temporary holding limits under consideration.

Mills said stablecoins have the potential to modernize retail and wholesale payments by making transactions faster and cheaper, but warned that growing adoption could also reduce bank deposits and, in turn, the amount of credit available to households and businesses.

The Bank of England has repeatedly pointed out the risk that large and rapid shifts from bank accounts into digital tokens could amplify stress during periods of financial instability.

Those concerns echo comments made earlier this month by Bank of England deputy governor Dave Ramsden, who said Britain may ultimately need to protect stablecoin holdings in a manner similar to bank deposits if such tokens become systemically important.

The debate is not limited to the UK, as Bank of America chief executive Brian Moynihan recently warned that stablecoins could pull trillions of dollars out of the U.S. banking system, particularly if issuers are allowed to offer yield on balances.

You May Also Like

Republic Europe Offers Indirect Kraken Stake via SPV

cpwrt Limited Positions Customer Support as a Strategic Growth Function