Optimism Approves OP Token Buybacks Using Superchain Revenue

- 50% of Superchain revenue will fund OP token buybacks.

- The program starts in February 2026 for one year.

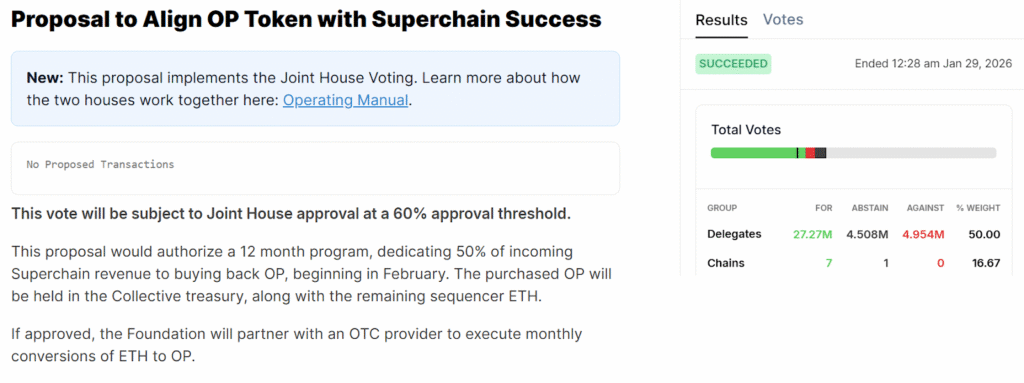

Optimism has officially approved a new OP Token buyback program. After the governance vote on January 28, 2026, the Optimism community approved the proposal with 84.4% support. The program will run as a 12-month pilot starting in February 2026.

The OP Token buy-back programs mean Optimism will use 50% of net sequencer revenue generated across the Superchain to buy back OP tokens every month from the market. The Purchase will be executed over the counter (OTC) to avoid sudden market price swings.

The superchain is a growing Ethereum Layer 2 chain that includes the major networks such as Base, OP Mainnet, and World Chain. These chains contribute a portion of their sequencer revenue back to Optimism. Over the past 12 months, the superchains generated around 6,868 ETH in Sequencer revenue. Under the approved plan, around 2,700 ETH per year, which is roughly around $8 million, could go towards the buyback program if the activity stays consistent.

However, all the repurchased OP tokens will then be sent to the Optimism Collective Treasury. Governance will later decide on the token to burn, using them for future staking or funding ecosystem incentives. The token usage is mainly under the governance control. The program includes built-in safeguards. Buybacks will pause automatically if revenue falls below set limits, and the execution pauses if operational requirements are not met. The governance will evaluate the performance before deciding whether to continue or change the model.

Why Is Optimism Doing Now?

The major reason for the Optimism to bring the buyback program is because of the rising concern from the OP token holders. The superchain was growing rapidly, but the OP token remains over 90% below its all time high. Layer 2 usage across the Superchain now represents a significant share of Ethereum activity.

Bobby Dresser, Optimism Foundation Executive Director, stated that the Buyback program is designed to connect OP’s value to real network usage rather than speculation, and this is the structural change, not a short-term attempt to raise the token price. This approval represents a shift from the governance token towards an economic alignment with network usage.

Highlighted Crypto News:

XRP Millionaire Wallets Rise Again in Encouraging Sign for Long-Term Holders: Santiment

You May Also Like

Zaldy Co asks SC to halt graft reso

Crypto Executives Advocate for U.S. Strategic Bitcoin Reserve Legislation