Bitcoin Price Slides After US Admits Nearly 1 Million ‘Phantom’ Jobs in Data Revision

Bitcoin price did not just dip. It reacted to something way bigger.

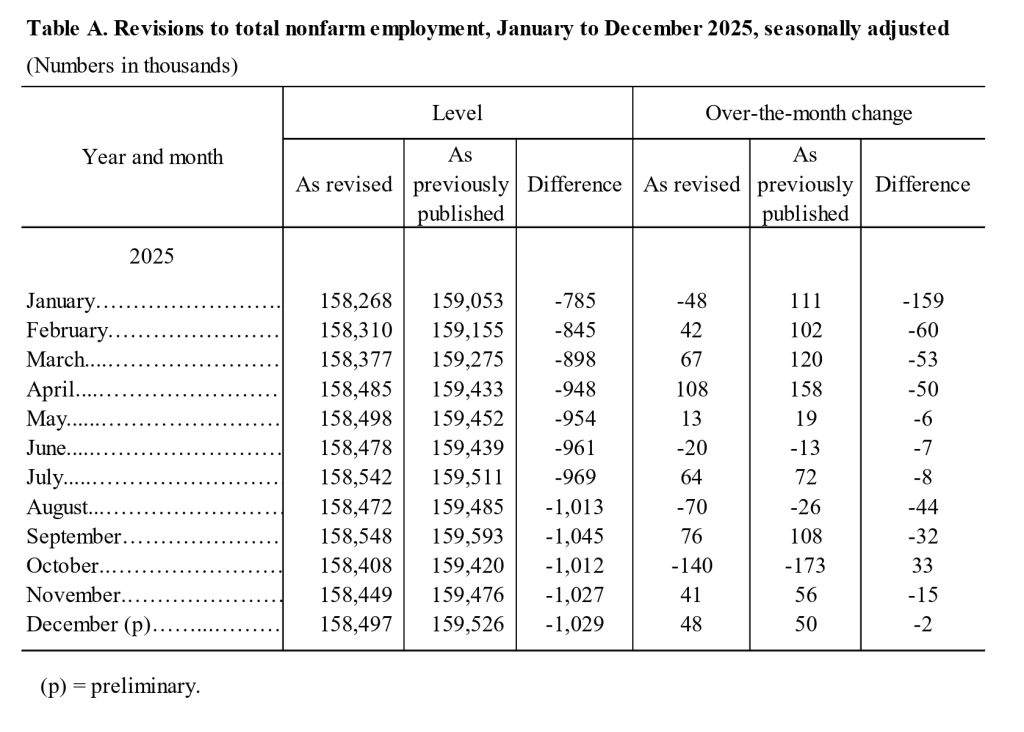

The U.S. government revised last year’s job numbers down by nearly 900,000 positions.

Markets hate one thing more than bad news. They hate unreliable data and uncertainty.

This update from the Bureau of Labor Statistics just shook confidence hard. January showed 130,000 new jobs. Fine on the surface. But the massive downward adjustment for 2025 changes the entire story.

Source: Bureau of Labor

Source: Bureau of Labor

Much of the reported strength was based on preliminary estimates, including the birth–death model, which can overstate job creation during periods of economic transition.

Discover: Here are the crypto likely to explode!

What Does This Mean for Bitcoin Price?

Since this increase in uncertainty, Risk assets got hit. Treasury yields jumped, with the 10 year moving from 4.15% to 4.20%.

Uncertainty is poison for markets. You can see it in the derivatives flows. Whale perp activity is spiking, which points to institutions hedging hard against more downside.

Rate cut odds for March collapsed from 22% to 9% in minutes. That kind of shift changes the entire market mood. Add fresh warnings about volatility risks across large chunks of BTC supply and the setup gets even heavier.

Could this be the bottom? Maybe. But the way the market is behaving, it does not look ready to commit to that idea just yet.

Keep your eyes on the bond market. As long as yields keep pushing higher, Bitcoin will have a hard time finding stable ground. That is just how the liquidity game works.

Still, chaos has a funny way of creating opportunity.

Discover: The best pre-launch crypto sales right now.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

TON Technical Analysis Feb 14