Hedera Positions Web3 Rails for the Rise of Agentic AI Payments

- Hedera has unveiled x402, a new payment standard that will enable small programmatic payments in the agentic AI economy.

- x402 utilizes existing standards such as the HTTP 402, making it easier for developers to build new rails over the existing internet infrastructure.

Hedera is targeting the rise of AI agents and it’s betting big on their increasing abilities to go beyond reasoning into shopping, subscribing and making payments. The network has launched a new payment standard that mainly targets this agentic AI economy.

The new standard is known as x402 and it enables tiny payments over Hedera’s decentralized network, powered by HBAR or any other crypto.

In a blog announcement, the network’s developer advocate Lindsay Walker said that x402 will enable small programmatic payments that AI agents and applications can execute automatically without the friction of traditional payment rails.

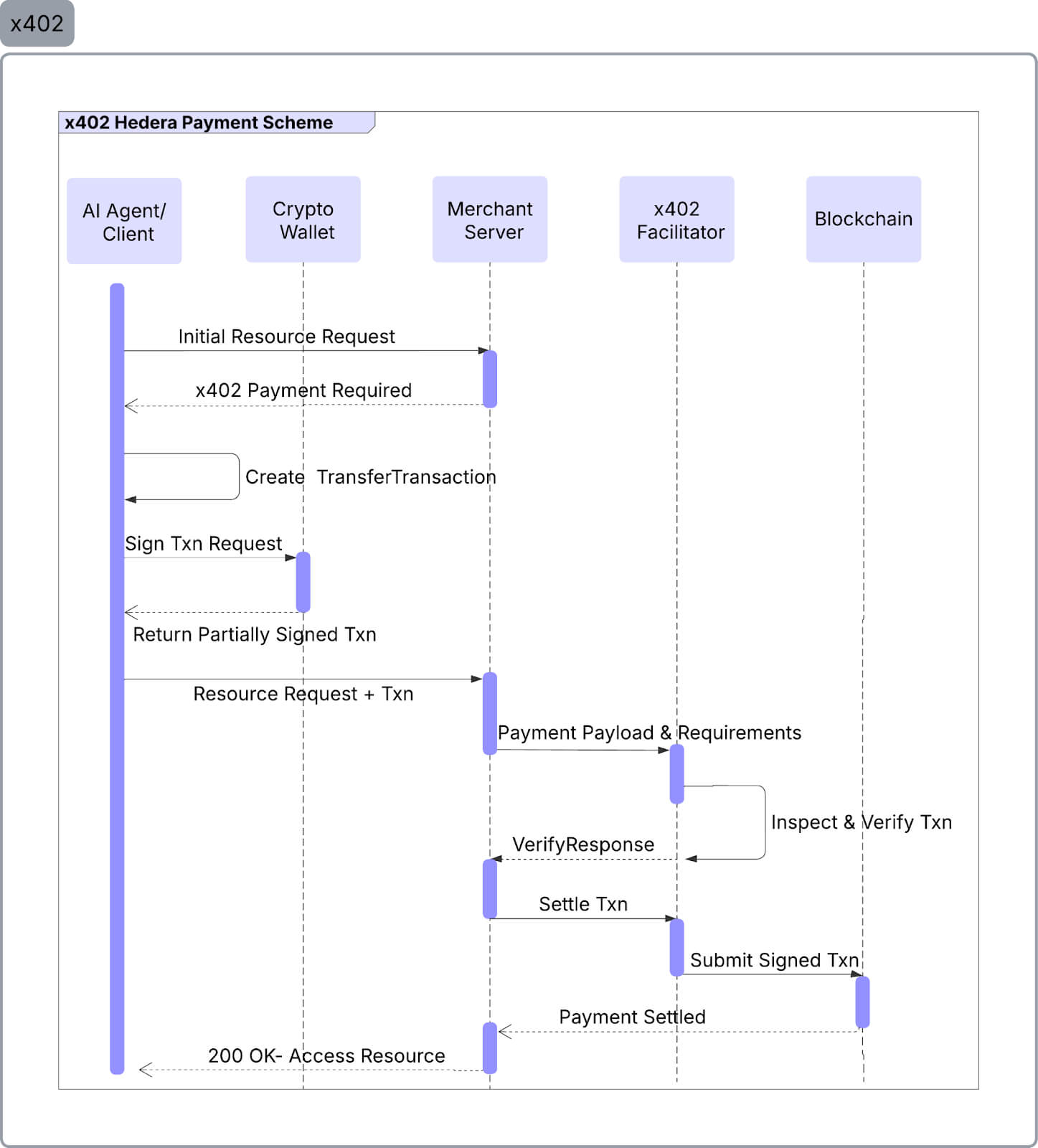

x402 is built on existing technology for easier integration. It utilizes HTTP 402’s ‘Payment Required’ code, expanding it to support digital assets. Walker says that this will make payments by applications and AI agents as easy as sending an HTTP request, which is how websites have been communicating for decades.

x402 is an open payment standard and therefore, it can be customized for any network or token. Under the Hedera implementation, developers will use a partially signed transaction model where the facilitator will pay the gas fees and submit the transaction.

Image courtesy of Hedera.

Image courtesy of Hedera.

Under this setup, once a client requests for any resource, such as access to a website, they will receive a 402 “payment required” message describing the cost of access. The payment is then made, before the partially signed transaction is forwarded to a facilitator, who then checks it and, after paying the gas, submits it to the Hedera blockchain for final settlement.

Facilitators handle the gas fees and where required, convert the cryptos if the payment is made in another token or a stablecoin held on another chain. One of the facilitators already available on the network is Blocky402, which offers similar services to other networks like Solana, Avalanche, Arbitrum, Base and Optimism.

AI Agent Payments on Hedera

Hedera becomes the latest blockchain to launch new services targeting AI agents. As we reported, Sui published a new post last month detailing why it’s the best network for the agentic AI economy, claiming it offers an execution environment that can coordinate multi-step actions between the agents and settle them in a single result.

ICP has launched the second version of its Caffeine AI platform, while Arbitrum and Polygon have expanded their AI infrastructure by supporting Ethereum’s ERC-8004 standard for communication between autonomous AI agents. Ethereum had announced a week earlier that this standard was launching on its mainnet.

While most networks have focused on identity and trustlessness, such as with Ethereum’s ERC-8004, Hedera says payments are a more critical aspect. Currently, most people would be hesitant to give AI agents access to their bank accounts. Those who decide to open a separate account for these agents with limited funds must contend with human identity checks, high fees, slow transactions and complex processes.

Digital assets solve this challenge, Walker stated, adding:

HBAR trades at $0.09404, gaining 7% in the past day to push its market cap above the $4 billion mark. In the past week, it has gained over 15% to recover some of the value lost in this month’s market wipeout.

]]>You May Also Like

Ethereum Foundation Leadership Update: Co-Director Tomasz Stańczak to Step Down