White Whale (WHALE) Price Prediction 2026–2030: Can WHALE Hit $0.4200 Soon?

- White Whale posts a decisive breakout, signaling strong bullish momentum entering 2026.

- Overbought indicators suggest short-term consolidation may occur before the next major expansion.

- Long-term projections remain bullish, with $0.4200 emerging as a realistic target if support holds.

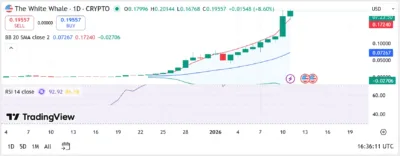

White Whale (WHALE) has entered 2026 with a powerful bullish breakout, surging above key resistance levels and drawing renewed attention from traders. Currently trading near $0.1955, WHALE has recorded a strong daily gain, reflecting aggressive buying pressure and expanding volatility. The breakout has pushed price well above the upper Bollinger Band, while momentum indicators confirm that bulls are firmly in control. Although short-term technical conditions appear stretched, the broader structure suggests that WHALE may be positioning for further upside if critical support zones remain intact.

The rally has reinvigorated interest in speculative altcoins, placing WHALE among the more technically compelling assets at the start of 2026. However, the sustainability of this momentum will depend on how price behaves during expected consolidation phases following such a rapid advance.

Also Read: Polygon Ecosystem Token (MATIC) Price Prediction 2026–2030: Can MATIC Hit $0.3000 Soon?

Market Sentiment and Momentum

Market sentiment surrounding WHALE has turned decisively bullish as buyers continue to dominate daily price action. The size and strength of the breakout candle suggest genuine accumulation rather than a temporary speculative spike. Rising volatility supports the view that WHALE is transitioning from accumulation into a momentum-driven expansion phase.

Despite the optimism, rapid rallies often invite short-term profit-taking. Traders are closely monitoring whether WHALE can maintain higher lows during any pullbacks, which would confirm strength and increase the probability of sustained upside continuation.

Current Market Overview

As of the latest data, WHALE is trading around $0.1955, registering a strong daily advance. Price has decisively moved above the 20-day Simple Moving Average, confirming a clear shift in short-term trend direction from neutral to bullish.

The breakout has also pushed WHALE above the upper Bollinger Band, highlighting strong upside momentum. While this confirms buyer dominance, sustained trading above the upper band typically leads to consolidation. A period of sideways movement above the breakout zone would help reinforce the bullish structure and support a continued advance.

Technical Analysis

From a technical perspective, WHALE remains firmly bullish, though signs of short-term exhaustion are beginning to appear. Price is advancing significantly faster than its underlying moving averages, reflecting a momentum-driven environment. The market’s response during any cooling-off period will be critical in determining whether WHALE can sustain its upward trajectory.

Bollinger Bands

The Bollinger Bands on the daily chart show a sharp expansion, underscoring a volatility-driven breakout. Price is trading well above the upper band, while the 20-day SMA remains far below current levels, illustrating the speed of the recent surge.

This setup confirms strong bullish conviction but also suggests that price is overstretched in the short term. A consolidation near the former resistance zone around $0.1720 to $0.1750 would represent a healthy technical development and help establish a stronger base for further upside.

RSI Behavior

The Relative Strength Index has surged to extreme levels, with readings near 93 placing WHALE deep into overbought territory. This reflects intense buying pressure and strong bullish sentiment, but it also increases the likelihood of a short-term pause or consolidation.

In strong trending markets, RSI can remain elevated for extended periods. A controlled pullback that keeps RSI above the 65–70 range would signal sustained bullish momentum, while a sharper decline below 60 would suggest weakening demand and increase downside risk.

Support and Resistance Levels

Immediate support for WHALE lies in the $0.1720 to $0.1750 region, which aligns with the prior resistance and recent breakout zone. Holding above this level would preserve the bullish market structure. Additional support exists near $0.1500, a psychological level that could attract buyers during deeper pullbacks.

On the upside, immediate resistance is found near the $0.2000 psychological level. A sustained move above this zone could open the door to higher targets at $0.2300 and $0.2800, with $0.4200 emerging as a key medium-term objective if momentum continues to build.

Source: Tradingview

WHALE Price Predictions (2026–2030)

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $0.1500 | $0.2100 | $0.2800 |

| 2027 | $0.1900 | $0.2600 | $0.3400 |

| 2028 | $0.2300 | $0.3200 | $0.4200 |

| 2029 | $0.3000 | $0.4000 | $0.5200 |

| 2030 | $0.3800 | $0.5200 | $0.6800 |

2026

In 2026, WHALE is expected to experience heightened volatility as traders react to its breakout structure. If price maintains support above the $0.1720 zone, the token could stabilize at higher valuation levels compared to late 2025. Consolidation phases followed by momentum-driven expansions could gradually push WHALE toward the $0.25 to $0.28 range.

2027

By 2027, improving liquidity and broader market participation could support a more structured uptrend. If overall crypto sentiment remains favorable, WHALE may benefit from stronger holder confidence, allowing price to trend toward the $0.34 region with reduced downside volatility.

2028

In 2028, WHALE could benefit from recurring speculative cycles within the altcoin market. Wider trading ranges are likely, but the broader trend may remain bullish. Under favorable conditions, WHALE could reach the $0.4200 level, marking a major milestone in its long-term growth trajectory.

2029

As WHALE matures in 2029, it could establish stronger price stability above $0.30, with pullbacks increasingly viewed as accumulation opportunities. Sustained trading interest and liquidity growth could support advances toward the $0.50 region during bullish market phases.

2030

By 2030, WHALE’s long-term outlook will depend largely on continued crypto adoption and market cycles. With favorable conditions, the token could enter a new growth phase and potentially trade above $0.60, supported by strong participation and deeper liquidity.

Conclusion

White Whale enters 2026 in a strong technical position following a decisive breakout above key resistance levels. While overbought conditions suggest the possibility of short-term consolidation, the broader trend remains bullish as long as WHALE holds above its breakout support zone.

If the token can continue building on its current momentum and successfully navigate consolidation phases, a move toward $0.4200 could become achievable within the next few years.

FAQs

1. What is the current market sentiment for WHALE in 2026?

Market sentiment is strongly bullish, supported by a clear breakout and aggressive buying pressure.

2. Is WHALE currently overbought?

Yes, RSI readings near 93 indicate that WHALE is in overbought territory, which is common during strong breakout phases.

3. Can WHALE hit $0.4200 soon?

If WHALE maintains support above $0.1720 and momentum continues, $0.4200 becomes a realistic target by 2028.

4. What are the key levels to watch?

Key support lies at $0.1720 and $0.1500, while resistance is located near $0.2000 and $0.2800.

5. What is the long-term outlook for WHALE?

With favorable market conditions, WHALE could continue appreciating through 2030, potentially trading well above $0.50.

Also Read: Pi Network Price Prediction 2026–2030: Can PI Hit $0.30 Soon?

The post White Whale (WHALE) Price Prediction 2026–2030: Can WHALE Hit $0.4200 Soon? appeared first on 36Crypto.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets