Bitcoin Trapped Below $90K: Key Metrics Reveal Market Standstill

Bitcoin continues to drop below 90,000 with network activity, and exchange flows registering annual lows, showing general market indifference towards traders.

The price of Bitcoin has been stuck at under $90 000 with major on-chain indicators sounding alarm bells. The cryptocurrency is under pressure due to the declining network activity. Market observers observe a peculiar lack of connection between price levels and real blockchain use.

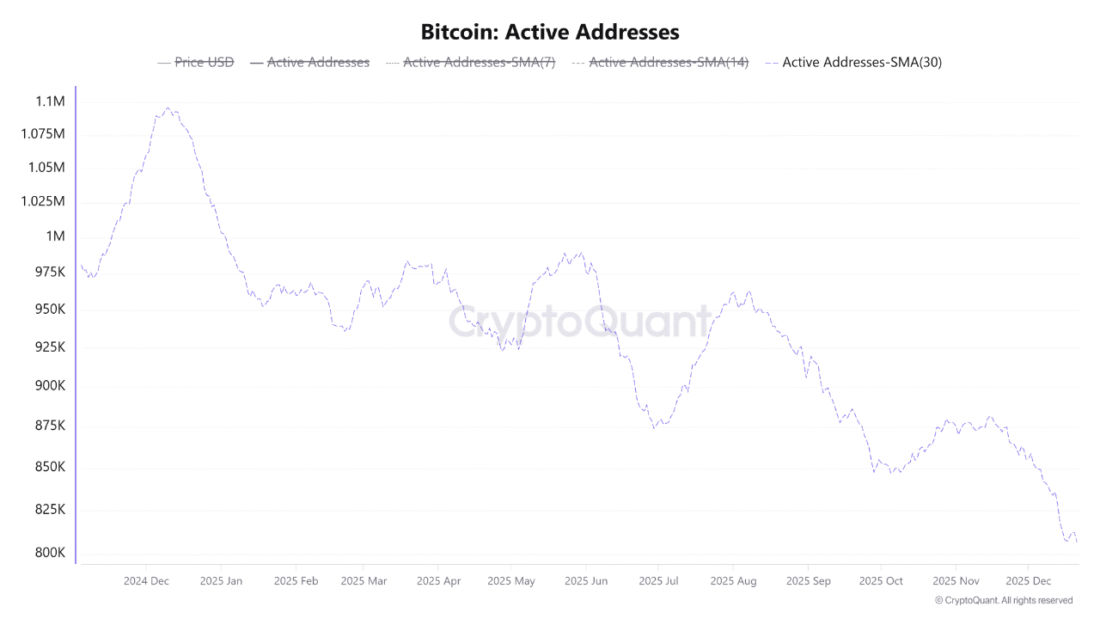

According to recent data provided by CryptoQuant, the utility of the Bitcoin network has cooled down sharply. Simple Moving Average (SMA) of Active Addresses 30 days decreased to the lowest point in the last year, 807,000. This fall indicates that there are fewer retail traders and speculators involved.

Source: CryptoQuant

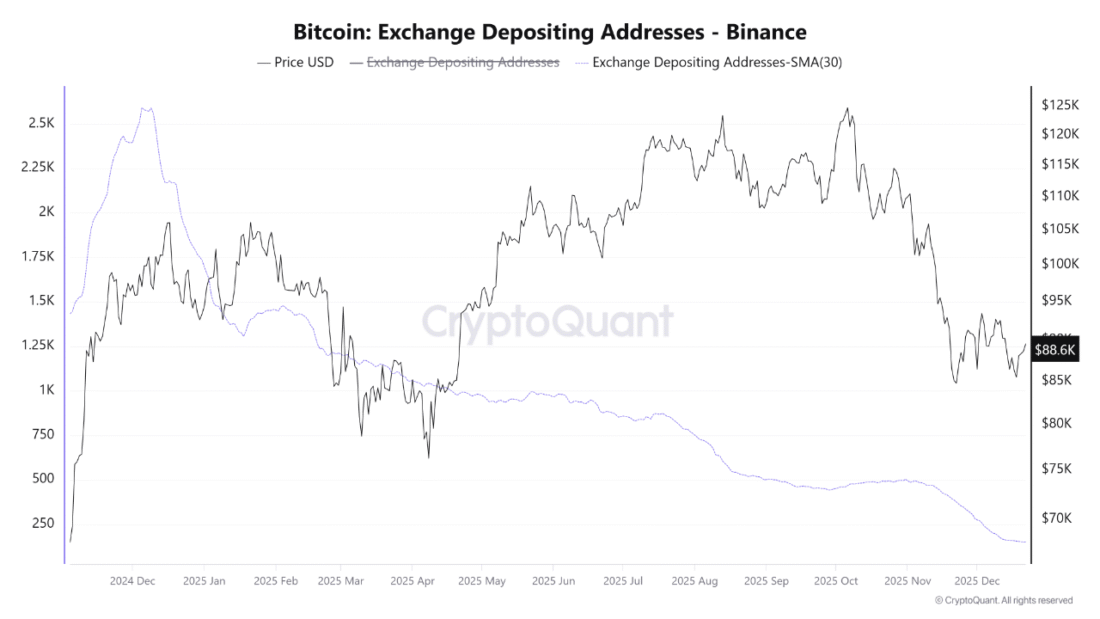

Exchange Activity Signals Complete Market Freeze

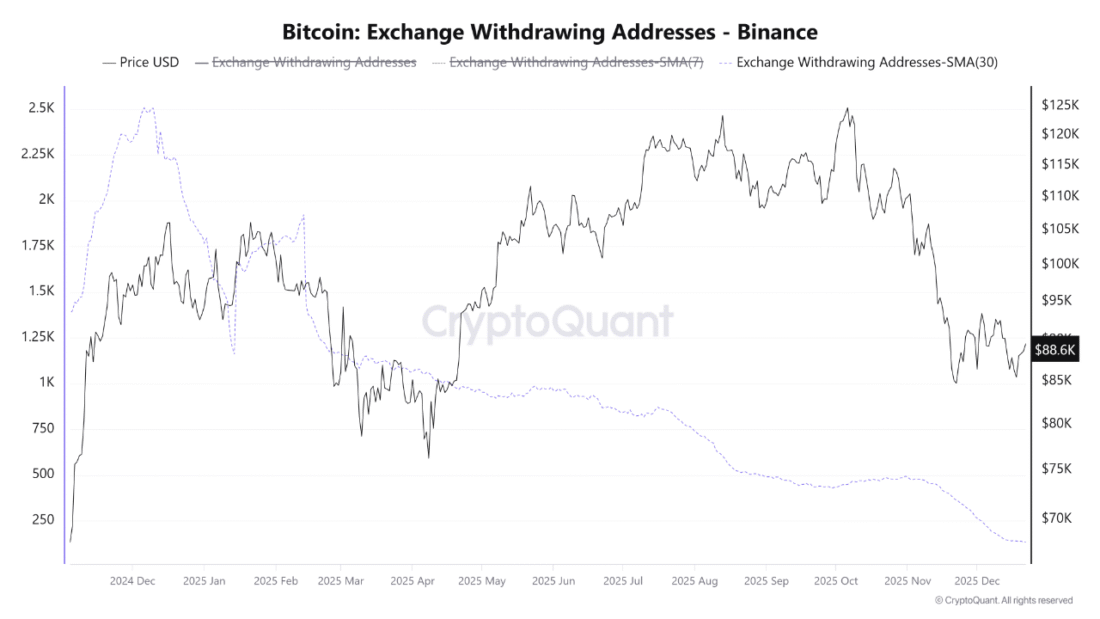

Binance flows leave an even bleaker impression of the present state of affairs. The amount deposited and the amount withdrawn were all at annual lows, indicating unprecedented market stagnation.

There is low deposit activity, which implies that long-term holders are not being motivated, even with the prices hovering around $88,000. Selling pressure is also low since coins are not on exchanges. But the withdrawal statistics tell a different tale.

The fact that there are limited withdrawals demonstrates that aggressive accumulation no longer happens. Investors are not stampeding to relocate assets to cold storage. Both bulls and bears are sitting on the sidelines.

You might also like: Monad Coinbase ICO Fallout Leaves Retail Investors Underwater

When Network Activity Diverges From Price Action

Bitcoin presents a distinct divide between its high price and low network activity- a look common to the extreme markets’ apathy. The two sides of the market have both drawn in.

Historical evidence shows that volatility spikes are often preceded by compressed on-chain activity. Markets are in search of a new equilibrium following prolonged periods of stagnation. The stalemate between the bulls and the bears cannot go on.

CryptoQuant termed the situation a stalemate in the market. When no one is trading, the price discovery grinds to a halt when participation has reduced to this extent.

Volume trading is still depressed at key exchanges, with the players waiting to get the right cues. The market is shivering and is waiting to be triggered. Bitcoin will probably remain range-bound below the level of $90,000 until the network activity takes a downturn or the selling pressure increases.

The post Bitcoin Trapped Below $90K: Key Metrics Reveal Market Standstill appeared first on Live Bitcoin News.

You May Also Like

Spanish Banking Powerhouse Santander Opens Doors To Crypto For The Public

The Top 10 Altcoins Most Purchased by Investors in 2025 Have Been Revealed! There’s a Trump Detail Too!