Canton’s CC Token Jumps on Christmas Eve as Institutions Drive the Privacy Narrative

Canton’s CC token emerged as the top gainer in the crypto market on Christmas Eve, rising more than 25% in 24 hours despite thin holiday liquidity and broadly bearish sentiment. The rally pushed CC ahead of major assets and privacy coins.

The move was not driven by retail hype or seasonal speculation. Instead, it reflected a growing institutional narrative around real-world asset (RWA) tokenization and regulatory clarity—two themes that have gained traction into year-end.

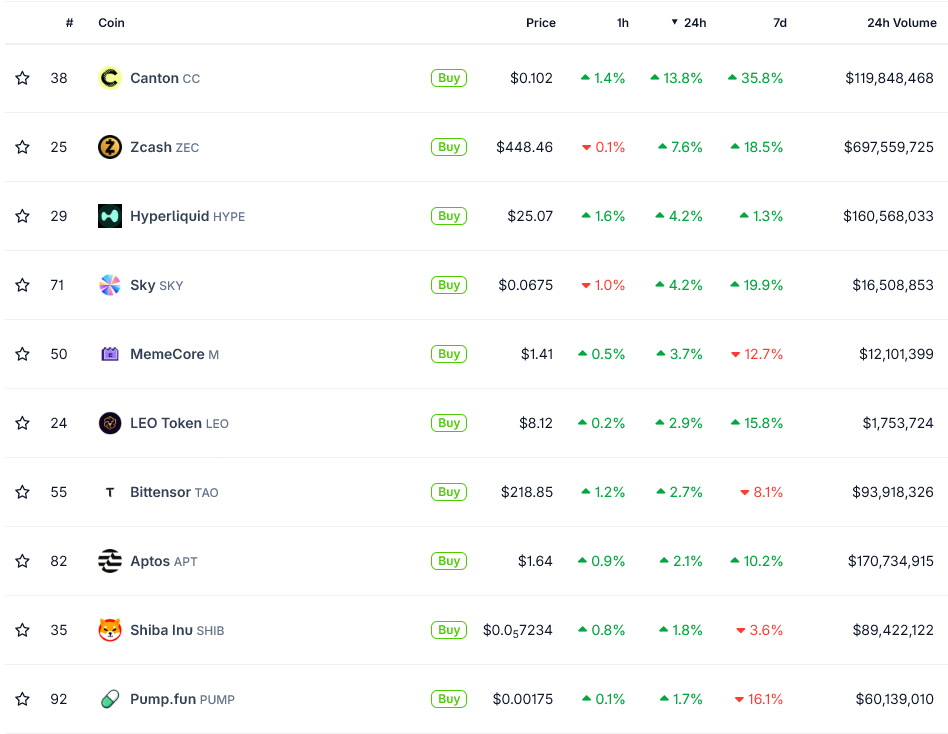

Top Gainers in the Crypto Market on Christmas Eve 2025. Source: CoinGecko

Top Gainers in the Crypto Market on Christmas Eve 2025. Source: CoinGecko

Institutional Tokenization Fuels Canton Token Rally

At the center of the rally is Canton Network, a privacy-enabled Layer-1 blockchain designed specifically for regulated financial institutions.

Unlike public DeFi chains, Canton allows institutions to transact on-chain while keeping sensitive data private. This is a key requirement for banks, clearing houses, and asset managers.

Canton’s utility token, CC, is used for transaction fees, network security, and validator incentives. Its value is tied less to retail activity and more to institutional usage.

That’s why price moves are highly sensitive to infrastructure-level developments.

Momentum accelerated after DTCC (Depository Trust & Clearing Corporation) confirmed progress on tokenizing DTC-custodied US Treasury securities on the Canton Network.

The initiative follows a regulatory green light from the US SEC, which issued a non-action letter allowing DTCC to proceed with live tokenization infrastructure.

That development marked one of the clearest regulatory endorsements yet for on-chain Treasuries.

As a result, markets began repricing Canton as core infrastructure rather than a speculative blockchain project.

Earlier in December, Canton also deepened its RWA stack through a partnership with RedStone, which became its primary oracle provider.

The integration enables real-time, compliant price feeds for tokenized assets, bridging institutional markets with DeFi without compromising privacy.

Together, these developments position Canton as a settlement layer for trillions of dollars in traditional financial assets.

Industry estimates place more than $300 billion in daily transaction volume already flowing through applications built on the network.

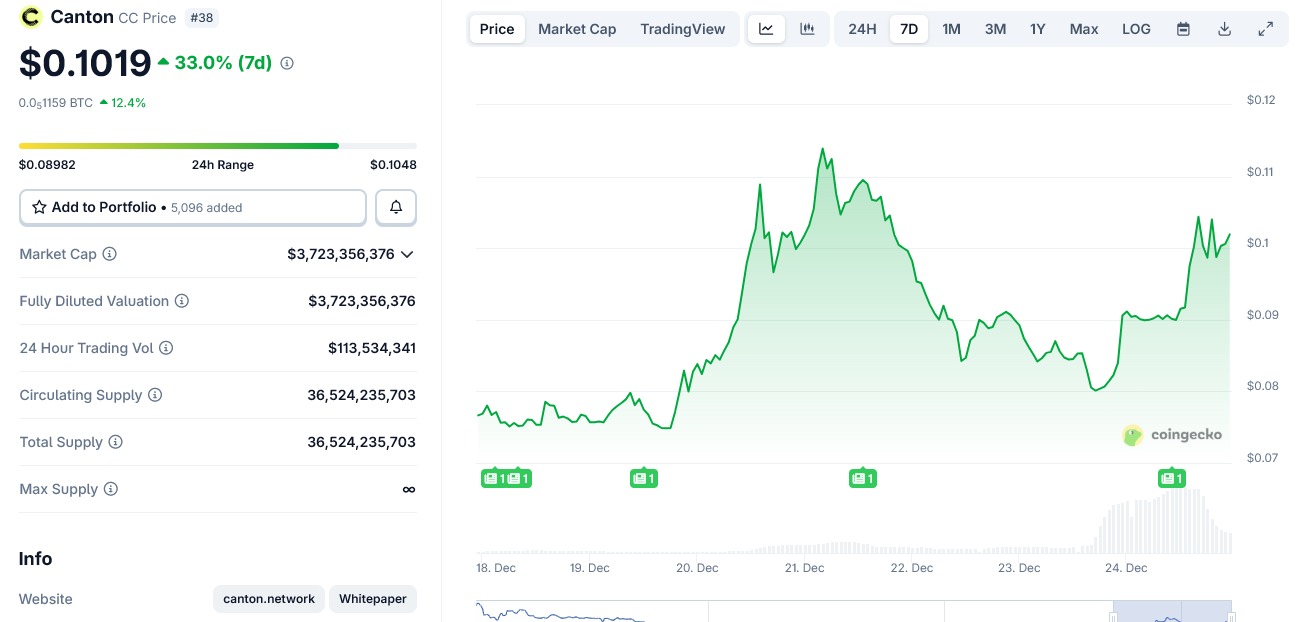

Canton CC Token Weekly Price Chart. Source: CoinGecko

Canton CC Token Weekly Price Chart. Source: CoinGecko

Importantly, the rally came during a low-liquidity holiday session. That context amplified the move but also highlighted where capital is concentrating ahead of 2026: compliant tokenization infrastructure.

While broader crypto markets remain cautious, CC’s performance underscored a growing divergence.

Investors are increasingly differentiating between speculative tokens and protocols tied directly to regulated financial adoption.

On Christmas Eve, Canton sat firmly in the latter camp—and the market reacted accordingly.

You May Also Like

The most profitable crypto narratives of 2025: RWA and Layer 1 lead the pack, AI and Meme experience significant pullbacks, GameFi and DePIN lead the declines.

Chris Burniske Forecasts Big Changes Coming to Cryptocurrency Market