Worldcoin Gains 6% From Demand Zone As Bulls Eye $1.50 Price Target

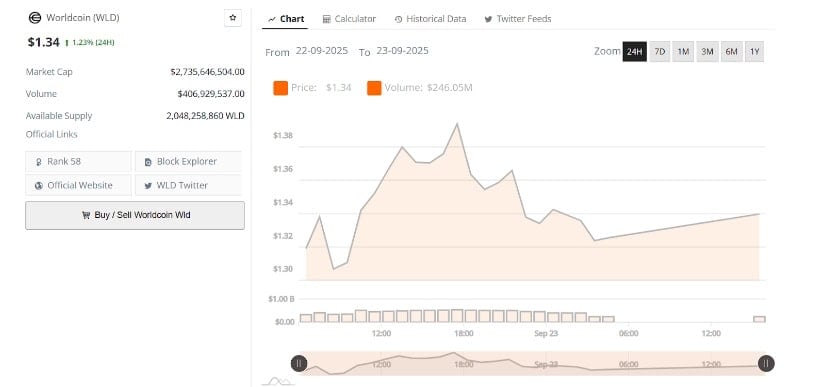

Analyst Tawfeeq highlights that WLD already posted a 6% rebound from $1.3080 without leverage, underscoring strong buying interest around this base. The 4-hour chart shows active market participation, with current trading near $1.34 and 24-hour volume of $406.9 million, reinforcing solid liquidity.

This consolidation zone is crucial for its short-term and medium-term outlook. A sustained hold above the $1.30–$1.40 area could trigger a broader pump, with initial resistance at $1.37–$1.40 and potential upside toward $1.50 and $1.64. Conversely, failure to defend this level may open deeper corrections toward $1.21 and $1.13.

Price Rebounds From Key Demand Zone

Worldcoin posted a 6% rebound after touching a strong demand zone between $1.18 and $1.30, according to analyst Tawfeeq. His 4-hour TradingView chart showed that the token gained around 6% from the $1.3080 level without leverage. The price area has served as a steady support range since early September and is being retested after a multi-week decline from levels above $2.20.

WLDUSDT Chart | Source:x

Tawfeeq stated that if the market holds this support zone, the current upward push may continue toward higher levels. The immediate resistance sits near $1.37 to $1.40, an area where sellers previously limited upside moves. A close above this range could encourage further buying from both spot and derivatives traders, increasing the possibility of reaching the $1.50 mark.

Short-Term Support and Trading Activity

Worldcoin traded at $1.34, recording a 1.23% gain in the past 24 hours. Trading data show that the crypto opened near $1.30 and reached an intraday high of around $1.38 before pulling back to current levels. This movement was supported by a 24-hour trading volume of about $406.9 million, pointing to sustained market participation and liquidity.

WLDUSD Chart | Source: BraveNewCoin

Price action during the session included an early strong advance, followed by a gradual retracement. After peaking near $1.38, the altcoin corrected but stabilized above $1.32, where buying interest increased. This behavior suggests the $1.32–$1.34 range is acting as a near-term support zone, offering a base for any further attempts to revisit recent highs.

Market Position and Key Levels Ahead

With a market capitalization of around $2.73 billion and a circulating supply of over 2.04 billion tokens, Worldcoin ranks 58th among cryptocurrencies by market value. Analysts say sustained buying and a stable market could push it past $1.36–$1.38, targeting a potential move toward $1.50.

Maintaining support above the $1.30 zone remains essential for sustaining the current recovery. A close above $1.40 strengthens the outlook, while a drop below key demand risks deeper support tests and longer consolidation.

Daily Chart Signals From Broader Analysis

A daily chart shared by an analyst shows WLD/USDT trading near a horizontal zone of $1.30–$1.40. This area acted as strong resistance earlier in the year and is now serving as an important support level. Following a sharp rally to $2.20, the price has corrected through a series of downward moves and is now testing this reclaimed support.

WLDUSDT Chart | Source:x

If the asset manages to hold above this range, the projection points to a possible climb toward $1.64, which is the next major resistance. A daily close above $1.64 could pave the way for a move toward the $1.80–$2.00 zone. However, failure to hold this grey support area could lead to declines toward $1.21, $1.13, or even $0.95, as indicated by the lower horizontal markers on the chart. The coming daily closes will be crucial for confirming the medium-term direction.

You May Also Like

![Movement’s [MOVE] 13% rally grabs attention – Yet THESE signals favor bears](https://i0.wp.com/ambcrypto.com/wp-content/uploads/2025/12/MOVE-Featured-1000x600.webp)

Movement’s [MOVE] 13% rally grabs attention – Yet THESE signals favor bears

Hong Kong Proposes Digital Asset Trading Consultation