Chipper Cash stops burning cash after restructuring business

Chipper Cash, an African fintech that offers consumer payments, cross-border transfers, and US dollar virtual cards, stopped burning cash in the final quarter of 2025, generating enough operating revenue to cover its day-to-day expenses.

The milestone comes after years of restructuring and a sharp reset in fintech funding, underscoring the growing importance of cash discipline for African consumer fintechs still chasing scale.

The turnaround leans on a handful of core markets. Nigeria and Uganda are among its leading revenue drivers, alongside demand for US dollar virtual cards, a highly-placed source close to Chipper’s operations told TechCabal. The cards became more relevant as consumers struggled to pay for global services with local bank cards.

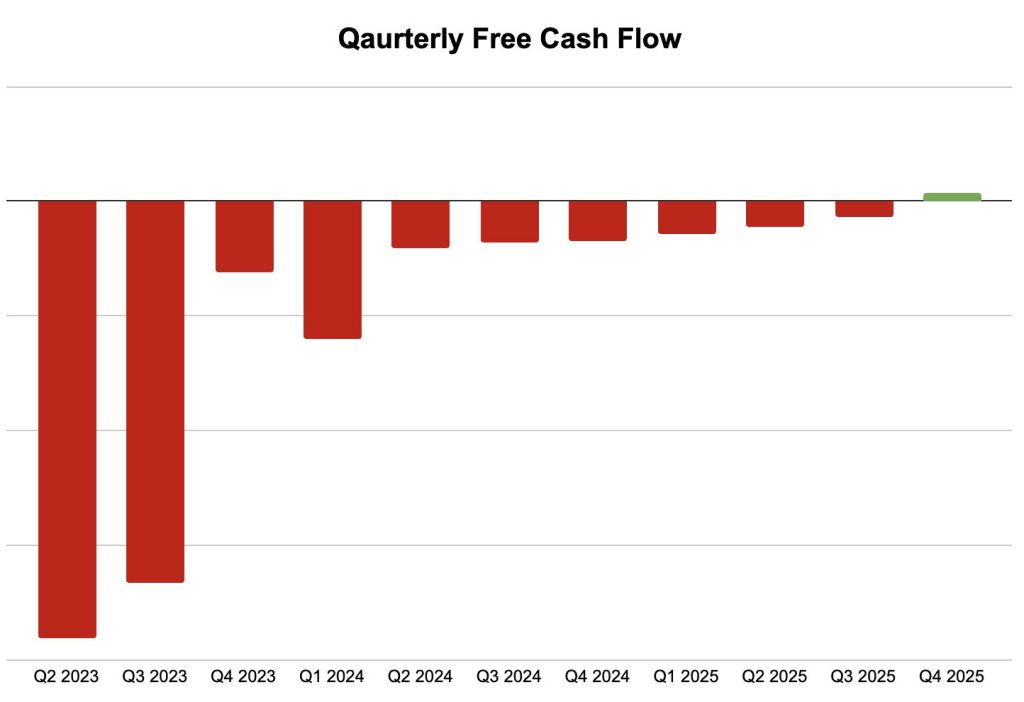

Quarterly free cash flow rose steadily and edged above zero in the final quarter of 2025, according to co-founder and chief executive Ham Serunjogi, who shared the update in a LinkedIn post on Tuesday.

Image: Ham Serugonji on LinkedIn

Image: Ham Serugonji on LinkedIn

“Achieving this as one of Africa’s few scaled fintechs – with hundreds of employees across the globe – is hard, especially considering the headwinds over the last few years,” Serunjogi said.

Chipper Cash moved away from rapid expansion to tighter control of margins and cash flow. Serugonji said the results showed the business could endure and secure its long-term viability.

“This is a direct result of their (employees’) dedication, proving that we can build a durable institution that will serve the continent for decades to come,” he said.

Chipper did not disclose any figures. Two former employees familiar with its finances told TechCabal the company is now profitable and has about 24 months of runway.

Chipper did not respond to a request for comments.

Nigeria’s foreign exchange reforms in 2023 reshaped demand for US dollar payments. After months of forex backlogs, the shift to a market-determined rate and looser pricing controls introduced sharp swings in spreads and fees. For fintechs, this volatility forced constant adjustments to pricing and product design.

“This achievement wasn’t easy and required some of the most difficult decisions in our history, including team restructurings over the last two years to ensure the company’s long-term viability,” Serunjogi added in this LinkedIn post.

Founded in 2018, Chipper operates consumer payments, peer-to-peer transfers, and remittance corridors across Africa, the US, and the United Kingdom (UK). It also offers cards and application programming interfaces (APIs) for businesses moving money in and out of the continent.

The company rode the venture boom to a $2.2 billion valuation in 2021, before sliding to to $250 million to $500 million, according to Forbes, after the collapse of backers including FTX, the digital currency exchange which filed for bankruptcy in late 2022, and Silicon Valley Bank (SVB), the US lender that served venture-backed startups and technology funds, as global tech valuations fell.

Rivals are under similar pressure as venture funding slowed, investors shifted focus to cash generation, and regulators increased scrutiny of payments firms across Africa. At the same time, FX volatility raised costs and squeezed margins. Fintechs like Flutterwave have cut costs, slowed expansion, and pulled back to core markets.

You May Also Like

Adoption Leads Traders to Snorter Token

Lovable AI’s Astonishing Rise: Anton Osika Reveals Startup Secrets at Bitcoin World Disrupt 2025