Bitcoin Surges Past $94K on Record ETF Inflows, Renewed Institutional Demand

Bitcoin climbed above $94,000 on Monday for the first time in 30 days as institutional demand surged through spot ETFs and sentiment indicators signaled a decisive shift in market positioning.

The benchmark cryptocurrency reached $94,634 during the session, and traded at $93,584 on Tuesday as time of publication, representing a gain of 0.8% over 24 hours. Ethereum traded at $3,228, up 1.76%, while XRP posted an 9.49% gain to reach $2.34, its highest level since November.

Record ETF Demand Returns

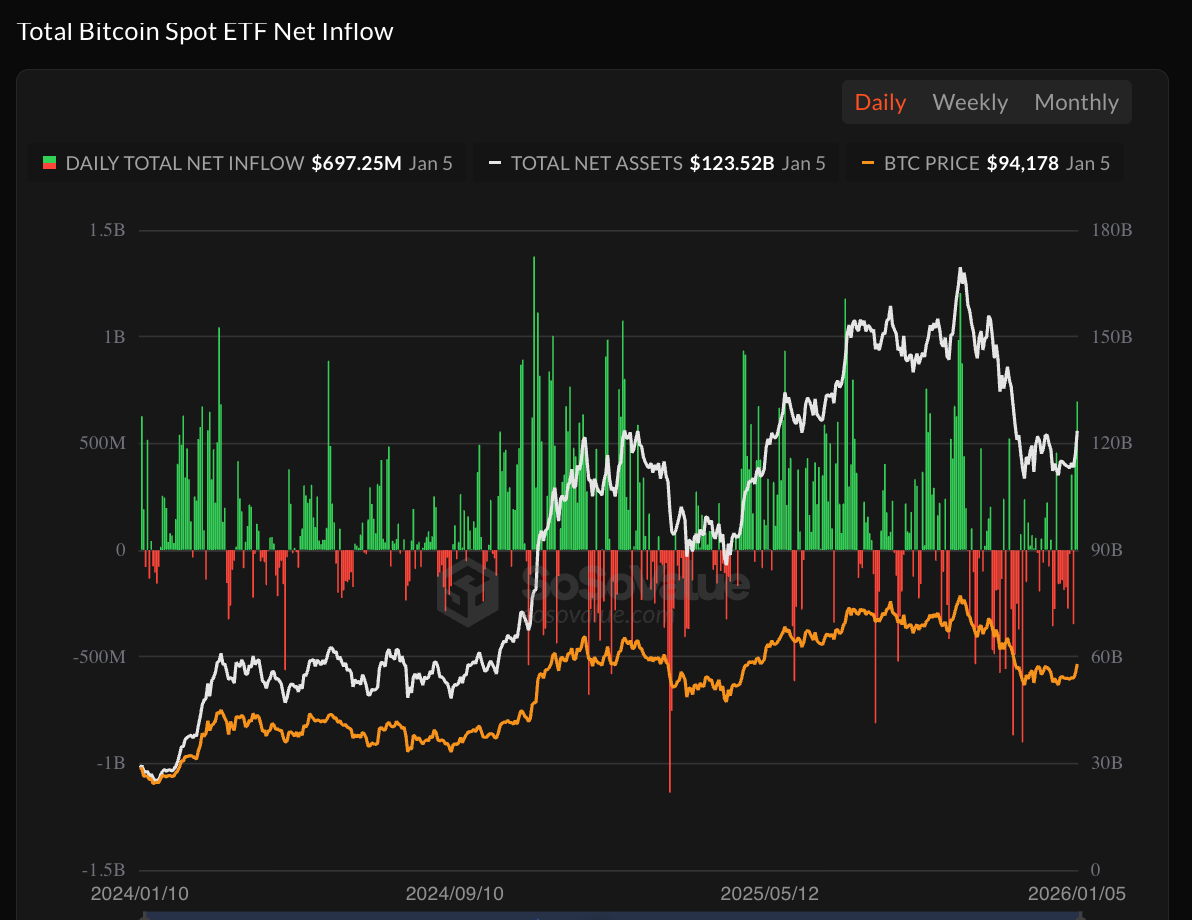

U.S. spot Bitcoin ETFs recorded $697 million in net inflows on January 5, marking the largest single-day inflow in over three months, per Sosovalue data. BlackRock's IBIT ETF led with $372 million in inflows, bringing its total historical net inflow above $62.7 billion.

The surge in institutional investment signals renewed appetite for Bitcoin exposure through regulated investment vehicles following the year-end holiday period when flows had stagnated.

Sentiment Indicators Flip Bullish, Crypto Stocks Rally

After 22 consecutive days in negative territory, the Coinbase Bitcoin Premium Index turned positive, indicating buying pressure during U.S. market hours is increasing and signaling a return of dollar-based capital to the market.

Options traders are positioning aggressively for further upside, with open interest for call options at the $100,000 strike price for January expiry now more than double the next most popular contract, according to Bloomberg data.

Crypto-related equities posted broad gains Monday. Coinbase rose nearly 8% to close just under $255, while Robinhood gained almost 7% to finish at $123. Mining firm BitMine Immersion Technologies climbed 7%, and Bitcoin treasury company Strategy advanced nearly 5%.

Macro Narratives Build

Market participants are citing several developing macro narratives as potential tailwinds. Unconfirmed rumors suggest Japan may be preparing to launch its own Bitcoin ETF, sparking speculation about a new major pool of institutional capital.

Analysts also point to the geopolitical situation following Venezuela's Maduro capture as a potential catalyst. Some theorize that U.S. control of Venezuelan oil could lead to lower energy prices and support monetary easing, benefiting risk assets. Additionally, speculation persists around Venezuela's rumored holdings of over 600,000 BTC, which if seized and held as a strategic asset could create significant supply constraints.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

ETH broke through $3100, up 0.14% on the day.