Why Yala's AI Agent Could Change How Traders Price Uncertainty Forever

How do you price the probability of an event that has never happened before? Traders face this question daily across prediction markets worth billions, yet they operate without the fundamental pricing tools that exist in every other financial market. Yala has announced Yala 2.0, an AI-native fair value agent system designed to transform how market participants assess and price uncertainty.

\ The shift happening in prediction markets mirrors the transition traditional finance underwent when quantitative models replaced gut instinct. The 2024 U.S. presidential election demonstrated this evolution. While polling agencies showed Trump and Harris in a statistical tie, Polymarket consistently priced Trump's odds higher throughout the race, and markets proved more accurate than polls. Yet even as prediction platforms gain legitimacy, they still lack what makes options markets function efficiently: systematic fair value models. Yala's three-stage roadmap addresses this structural gap by deploying AI agents that process market data, news flows, and behavioral signals into actionable probability estimates.

\

Why Fair Value Models Matter for Uncertainty Pricing

Options traders use Black-Scholes to calculate theoretical prices before entering positions. The model does not guarantee profits, but it provides a reference point that separates informed trading from speculation. Prediction markets currently operate without this foundation. Participants either build proprietary models with significant resources or trade based on intuition and sentiment, creating information asymmetry that limits market efficiency.

\ Kalshi's CFTC approval as a Designated Contract Market in 2023 formalized prediction platforms as financial infrastructure rather than gambling venues. This regulatory recognition came because these markets use order-book matching where traders negotiate prices representing probabilities, not bookmaker-set odds. The infrastructure designation brings legitimacy but also exposes a critical weakness. Without fair value references, pricing remains vulnerable to manipulation, sentiment cascades, and inefficient discovery.

\ The practical application of fair value in prediction markets follows established trading logic. When fair value exceeds the market price for a "Yes" outcome, statistical advantage favors buying Yes or selling No. When fair value falls below market price, the reverse position offers better expected value. This principle drives trillions in options trading volume, but prediction markets lack the systematic intelligence layer that enables such comparisons at scale. Polymarket processed $3.2 billion in trading volume during 2024, yet participants priced events without standardized valuation frameworks.

\ Yala's fair value agent attempts to solve this by integrating historical trading patterns, news event analysis, smart money tracking, and social sentiment into single probability outputs. The system does not predict outcomes with certainty but provides traders with a north star for navigating uncertainty, a reference signal that improves decision quality and long-term win rates in probability-based markets.

\

The Three-Stage Transformation of Uncertainty Pricing

\

Yala structures its development through three distinct phases, each expanding the system's scope and intelligence. The early stage focuses on establishing core methodology through closed testing of the first fair value AI agent. During this period, Yala releases probability estimates publicly through its X account, demonstrating calibration approaches and probabilistic reasoning frameworks before the full system launches. This stage prioritizes building a track record of accuracy and consistency that users can verify independently.

\ The mid-stage introduces the public-facing fair value AI agent with modular architecture designed for systematic probability generation. Users input three parameters: market type (sports or crypto), target condition (specific price, direction, or range), and time horizon (future timestamp). The agent outputs a probability estimate representing the likelihood of the specified condition occurring. This simple interface masks significant technical complexity underneath.

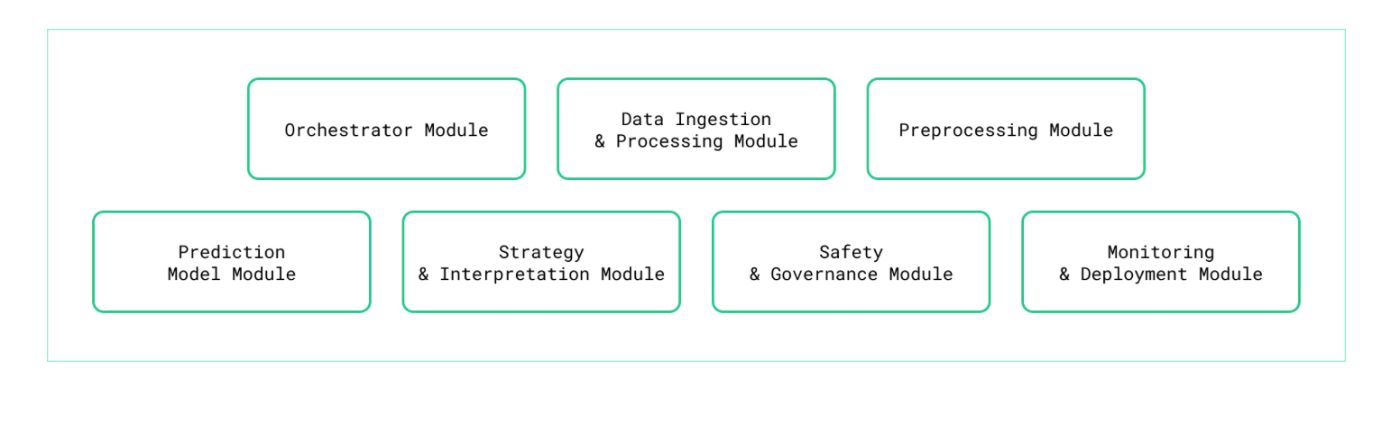

\ The system's architecture deploys a multi-agent framework coordinated by a central Orchestrator Agent. The Social Media Processing Agent analyzes sentiment dynamics across Twitter and X. The News Processing Agent processes events from Bloomberg and other sources. The Historical Market Data Agent ingests price series, volume, and order flow. The Smart Money Analysis Agent identifies informed trading patterns. These agents feed a Preprocessing Module that aggregates signals into unified model-ready data. Prediction models using LSTM networks, Transformer architectures, and time-series ensembles generate risk-neutral fair value estimates from this unified feature space.

\ The Strategy and Interpretation Module converts model outputs into actionable insights through specialized agents. The Quantitative Strategy Agent applies trading heuristics. The Market Sentiment Agent weighs behavioral factors. The Output Synthesis Agent packages everything into interpretable probability estimates. A Safety and Governance Agent enforces rules and compliance constraints across all decision flows. The entire system exposes its capabilities through MCP-compatible APIs for programmatic access and bot interfaces on Telegram and X.

\ The startup plans to validate this architecture through live trading with $1,000 to $10,000 in real positions. The agent will execute autonomous trades, allowing performance measurement under actual market conditions. Future enhancements include options-implied volatility factors, on-chain capital flow signals, Bayesian dynamic belief updating, and probability confidence scoring engines. The mid-stage represents Yala's transition from generating forecasts to operating a verifiable agent whose outputs face continuous market testing.

\ The late stage expands the system into a comprehensive multi-agent swarm capable of pricing uncertainty across any domain. Users can input any asset or event category (crypto, equities, elections, interest rates, sports) with a future time horizon. The system generates a complete probability density function rather than a single-point estimate. This PDF integrates subjective probabilities (incorporating sentiment and macro factors), risk-neutral probabilities (derived from no-arbitrage principles), confidence intervals, and distribution shapes. The output provides traders with a holistic probabilistic view of possible outcomes.

\

Multi-Agent Architecture and Economic Alignment

The late-stage architecture fundamentally changes how fair value gets generated and distributed. A Supervisor Agent coordinates specialized Worker Agents, each focused on distinct aspects of probability assessment. The Fair Value Modeling Agent selects appropriate valuation frameworks (risk-neutral, statistical, or subjective) based on event characteristics. The Data Collection Agent maintains continuous feeds of market data across historical and real-time sources. The Sentiment Analysis Agent quantifies narrative shifts from news and social media. The Smart Money Analysis Agent detects informed trading behavior, including Polymarket front-running patterns and high-conviction positioning.

\ The Event Tracking Agent monitors macro shocks, geopolitical developments, and regulatory changes that alter probability paths. The Options Analysis Agent computes implied probabilities from volatility surfaces, skew patterns, and open interest ratios. The Simulation Agent runs Monte Carlo scenarios to construct baseline probability distributions under different assumptions. The Decision Aggregation Agent synthesizes all Worker Agent outputs into consolidated fair value estimates with confidence intervals and interpretable explanations.

\ This architecture introduces an Insider/Private Information Adjustment Agent that allows traders to incorporate proprietary signals. The agent uses encrypted vector storage and confidential RAG pipelines to process private information without exposing it to other users or the broader system. This capability addresses a fundamental challenge in prediction markets: how to price events when some participants possess information advantages. By allowing secure signal integration, the company enables traders to refine subjective fair values while maintaining privacy protections.

\ Yala plans to launch invitation-based prediction vaults where advanced agents autonomously allocate capital and execute positions. Both the full multi-agent system and individual Worker Agents may be monetized through x402 paid access models or tokenized as separate economic entities. Agent tokens would entitle holders to revenue shares generated by specific agents, creating a decentralized, economically aligned agent ecosystem.

\ The YALA token functions as the governance and value alignment mechanism for this ecosystem. Staking YALA grants participation rights in multi-agent architecture decisions, including parameter updates, agent-level oversight, and platform-wide governance. Platform income from performance fees (generated by prediction vaults) and usage fees (charged when developers call Yala's AI agents) will fund periodic YALA buybacks. As new tokens emerge from individual Worker Agents or system expansions, YALA stakers receive distributions and airdrops, ensuring long-term participants capture value from ecosystem growth.

\

Why This Changes Uncertainty Pricing Permanently

\ Prediction markets currently function like pre-quantitative-revolution finance. Prices emerge from collective trader sentiment and capital flows, but without systematic reference models that enable rigorous valuation. Yala's approach parallels what quantitative trading did to equities and derivatives. By providing a fair value signal that processes multiple data sources through consistent probabilistic frameworks, the system creates a pricing standard that did not previously exist.

\ The implications extend beyond individual trader profitability. Market efficiency improves when participants can compare their probability assessments against a transparent, data-driven reference. Liquidity providers gain clarity on appropriate pricing ranges. Arbitrageurs can identify genuine mispricings versus noise. Information asymmetry decreases as fair value signals become accessible to retail participants who cannot build proprietary models. The entire market structure shifts toward more accurate probability discovery.

\ However, execution risk remains substantial. Fair value models succeed in options markets because underlying volatility follows established statistical properties with deep historical data. Prediction markets cover events with non-stationary probability distributions, sparse precedents, and asymmetric information. A presidential election has different dynamics than a sports match, which differs from crypto price movements. Yala's multi-agent system must dynamically adjust signal weights and modeling approaches across these diverse contexts without clear optimization criteria.

\ The mid-stage deployment with $1,000 to $10,000 capital provides insufficient scale to test slippage, liquidity constraints, and adverse selection effects. Individual Polymarket positions on major events regularly exceed $1 million. Smart money participants with proprietary infrastructure may arbitrage Yala's signals before retail users can act, especially if fair value estimates become publicly known. The system's value proposition depends on whether its probability estimates provide edge after accounting for transaction costs, timing delays, and market impact.

\ The tokenomics structure creates potential friction. Revenue from vaults and API usage funds YALA buybacks, but launching separate agent tokens fragments value capture. If Worker Agents issue individual tokens with independent revenue streams, YALA's position as the central economic anchor weakens. The x402 paid access model combined with multiple token layers may complicate governance and reduce capital efficiency. Successful DeFi protocols typically concentrate value in a single asset. Yala's multi-token architecture distributes claims across competing instruments, potentially diluting long-term value accrual.

Final Thoughts

Yala addresses a genuine market structure problem. Prediction markets have grown to institutional scale without developing the pricing infrastructure that makes traditional financial markets efficient. The platform's three-stage roadmap, modular agent architecture, and emphasis on live performance validation demonstrate thoughtful product development rather than speculative promises.

\ Whether Yala's AI agents permanently change uncertainty pricing depends on empirical performance. Fair value models add value when they process information faster than markets or exploit persistent behavioral biases. Prediction markets already attract sophisticated participants building proprietary systems. Yala must prove its multi-agent approach generates probability estimates more accurate than existing market prices after execution costs. The upcoming mid-stage live trading phase will provide initial data, but meaningful validation requires sustained performance across diverse event types with transparent reporting of win rates, calibration scores, and risk-adjusted returns. If Yala's agents consistently outperform market consensus, they establish a new standard for pricing uncertainty. If they match or underperform existing prices, the infrastructure remains impressive but economically irrelevant.

\ Don’t forget to like and share the story!

You May Also Like

Adoption Leads Traders to Snorter Token

Lovable AI’s Astonishing Rise: Anton Osika Reveals Startup Secrets at Bitcoin World Disrupt 2025