Solana Price Soars 4% Even As Glassnode Warns SOL Liquidity Sits At ‘Deep Bear Market’ Level

The Solana price has soared 4% in the last 24 hours to trade at $138 as of 3:55 a.m. EST on a 40% surge in daily trading volume to $6.5 billion.

This comes even as blockchain analytics firm Glassnode warns that Solana’s liquidity ”has contracted back to levels typically seen in deep bear markets.”

It added that for SOL that means realized losses now exceed realized profits.

The low liquidity warning suggests that even small trades could cause sharp price movements, making the market more volatile in the short term.

Solana’s on-chain liquidity index has dropped back to zero, marking another clear “reset” phase similar to those seen in March, June, and November. Each of these resets has historically pushed SOL into a cooling period before liquidity gradually rebuilds during an “ignition” phase.

The chart highlights three major cycles lasting 79 days, 41 days, and 43 days. In all cases, liquidity collapses sharply, stays low for a short stretch, and then climbs again, often supporting a new price upswing.

With the current November reset now confirmed, SOL is sitting in another low-liquidity pocket. If previous patterns repeat, the next move will depend on how quickly liquidity starts returning to the network.

A rising index has consistently signaled the beginning of fresh momentum for Solana, making this metric key to watching the next potential recovery stage.

Solana Holds Key Support As Descending Wedge Signals Possible Bullish Reversal

The SOLUSDT trading pair is near a major multi-month support zone around $130–$140, which has acted as a strong demand area in the past and even formed the base of a double-bottom pattern earlier in the year.

This support level has repeatedly stopped deeper sell-offs, making it an important region for bulls to defend. As long as SOL holds above this zone, the likelihood of a bullish reversal remains strong.

The price is currently positioned below both the 50-day SMA ($184.65) and the 200-day SMA ($169.79). This alignment shows that the broader trend is still bearish, with sellers maintaining overall control.

For bullish momentum to return, SOL must reclaim these two moving averages, as they will act as major resistance barriers on any upside attempt. A daily close above the 200-day SMA would be the first clear signal of trend recovery.

SOLUSDT Chart Analysis. Source: Tradingview

A descending wedge pattern is forming on the chart. This is typically a bullish reversal pattern, especially when it appears near a strong support zone. The wedge shows that the rate of decline is slowing, and sellers are losing strength. If SOL breaks above the wedge’s upper trendline, it could spark a move toward the next resistance levels.

The immediate resistance lies at $155–$160, an area where previous breakdowns occurred and where the price has struggled to move higher. A breakout above this range would likely attract new buyers and push the price toward the 200-day SMA. Above that, the next major zone sits between $200–$250, which aligns with previous swing highs and the upper resistance highlighted in the chart.

The RSI near 38 shows that SOL is close to oversold territory. This indicates that selling pressure may be easing and that the price could be preparing for a rebound. Failure to break these levels may result in the price consolidating or dropping slightly.

Related Articles:

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

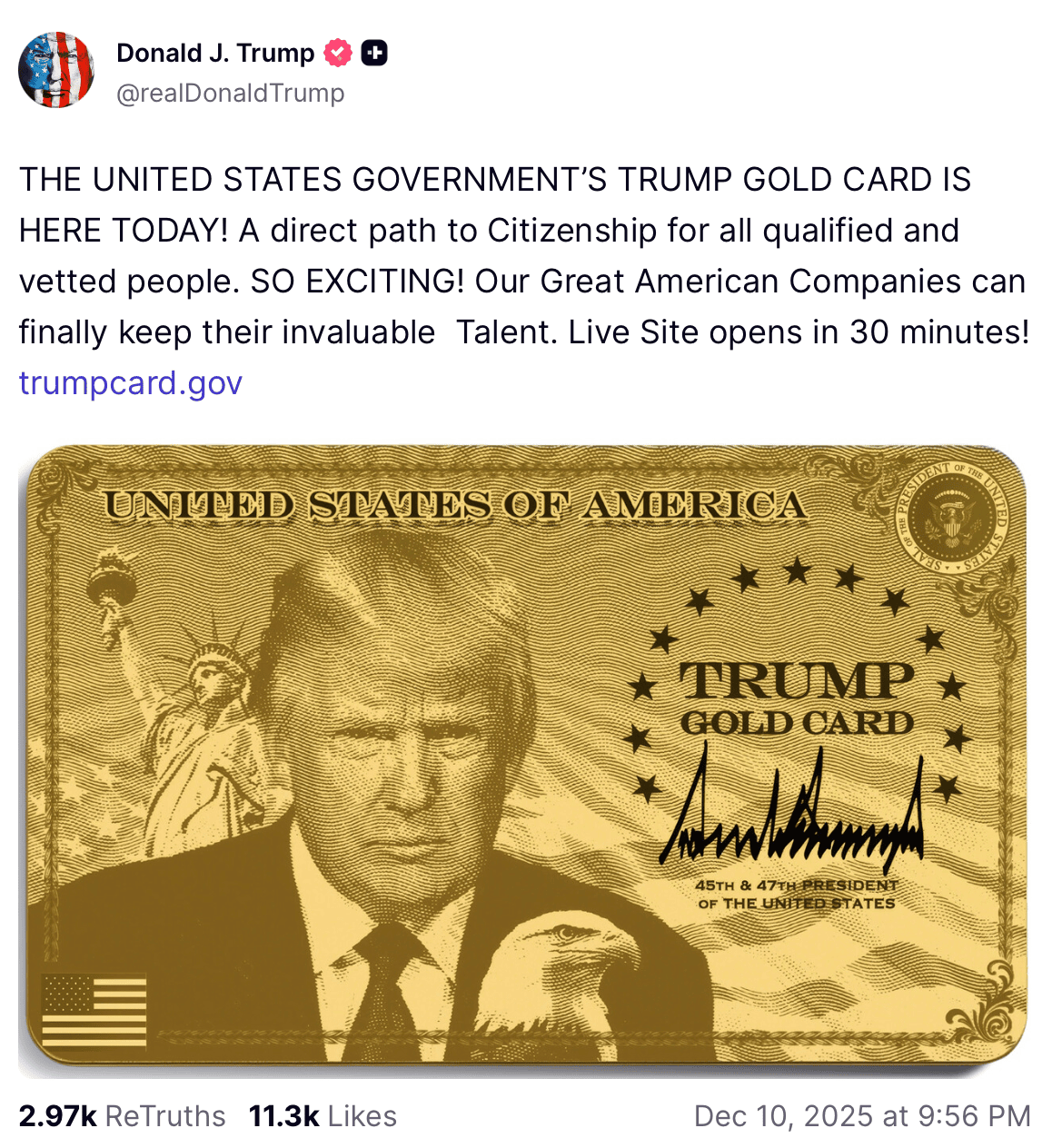

Trump Announced the Launch of the Trump Gold Card