Ethereum’s price is holding near the $3,000 support level amid a significant drop in exchange supply to decade lows, signaling strong holder conviction and potential for upward momentum as institutional interest grows.

-

ETH maintains $3,000 support and faces $3,100 resistance, key levels guiding short-term trader decisions.

-

Exchange supply hits lowest since 2015 at 8.7% of total ETH, indicating reduced selling pressure and increased long-term holding.

-

Fundstrat’s Tom Lee views ETH as undervalued at $3,000, with institutional accumulation exceeding $11 billion and potential price targets up to $62,000.

Ethereum price holds $3K support as exchange supply plummets to 2015 lows, boosting investor confidence. Discover key technical levels and expert insights driving ETH’s next move—stay informed on crypto trends today!

What is Driving Ethereum’s Price Stability Near $3,000 Support?

Ethereum price support at around $3,000 is proving resilient amid weekend market dynamics, with traders closely watching this level as a potential entry point following recent reversals. The cryptocurrency’s position reflects broader trends of reduced exchange supply and growing institutional involvement, which could sustain momentum if key resistance at $3,100 is breached. Analysts emphasize patience during low-liquidity periods to avoid choppy price action.

ETH trades near $3K support as exchange supply drops to decade lows, drawing attention from traders and institutional investors alike.

- ETH is keeping the $3,000 support zone and the $3,100 resistance which will be an indicator of short-term trading patterns to the traders.

- ETH on exchanges is at its lowest point since 2015, only 8.7% of ETH is on exchanges, which represents a sign of reduced liquidity and more long-term holding activity.

- Fundstrat’s Tom Lee calls ETH undervalued at $3K, noting institutional expansion and significant fund accumulation influencing market sentiment.

ETH saw renewed attention as traders monitored key support levels and broader supply trends shaping market expectations. Market participants assessed whether current pricing can sustain momentum during a period known for slower weekend activity.

How Does Ethereum’s Exchange Supply Impact Price Dynamics?

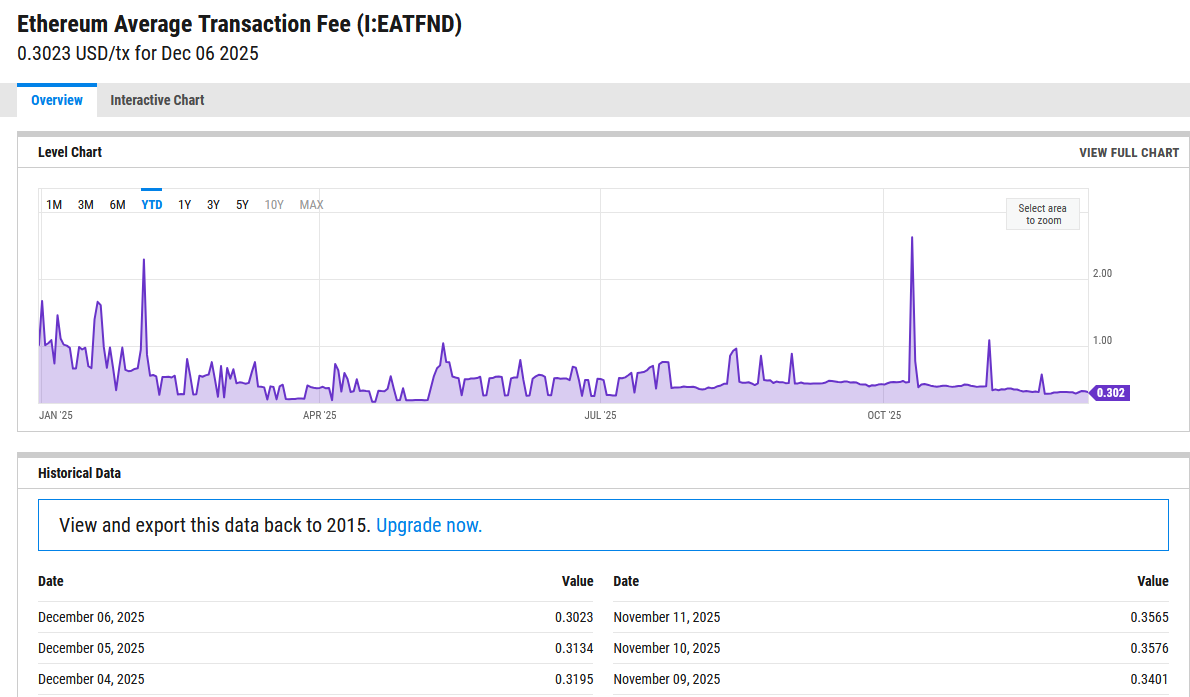

Ethereum’s exchange supply has reached its lowest level since 2015, with only 8.7% of the total supply now held on centralized exchanges, according to data from Coin Bureau. This decline underscores a shift toward long-term holding, where investors are moving assets off platforms to secure wallets, thereby limiting immediate sell pressure. Such trends often precede price appreciation as reduced liquidity amplifies the effect of buying interest; for instance, historical patterns show that supply drops below 10% have correlated with 20-50% rallies in subsequent months.

ETH analyst Lennaert Snyder noted that the asset is holding its ~$3,000 support area, a level he described as a possible entry zone after confirmed reversals. He added that weekend trading often brings choppy movement, so patience remains important. Snyder explained that the ~$3,100 level, now acting as resistance, could form short opportunities if price fails to reclaim it, or long setups if the level is regained.

Lower exchange balances signal confidence among holders, particularly as Ethereum’s network sees expanding use in decentralized finance and layer-2 solutions. Experts from Glassnode have observed that this supply metric has been trending downward for over two years, aligning with staking growth where more than 30% of ETH is now locked in protocols. This structural change reduces volatility from retail selling and positions Ethereum for steadier growth, especially if macroeconomic conditions improve.

In practical terms, the low supply means that even moderate inflows from institutions could push prices higher. Traders are advised to monitor on-chain metrics like withdrawal volumes, which spiked recently, further evidencing the holder exodus from exchanges.

What Role Do Institutional Investors Play in Ethereum’s Valuation?

Fundstrat’s Tom Lee highlighted Ethereum’s undervaluation at $3,000 during Binance Blockchain Week Dubai, pointing to the BTC/ETH ratio at 0.25 as a sign of significant upside potential, with estimates ranging from $12,000 to $62,000. He attributed this to heightened institutional activity from firms like BlackRock and JPMorgan, which are integrating Ethereum-based assets into their portfolios. Lee’s fund alone holds over $11 billion in ETH, reflecting ongoing accumulation that bolsters market sentiment.

He stated that traders should also watch for a possible sweep of recent lows, especially if Bitcoin moves lower. Further ETH retracement to the $2,800 range can occur in case the $3,000 range is breached. Snyder pointed out that the market can be quiet till the beginning of the new week, which will make the chances of significant movements in the short term low.

His assessment placed attention on structure rather than directional calls, with traders monitoring how ETH behaves around these technical areas during reduced-liquidity conditions. Institutional involvement extends beyond holdings; reports from Bloomberg indicate that Ethereum ETFs have seen net inflows exceeding $5 billion year-to-date in 2025, driven by regulatory clarity and network upgrades like Dencun, which lowered transaction costs by up to 90%.

At Binance Blockchain Week Dubai, Fundstrat’s Tom Lee indicated that ETH is underperforming by an obscenely large margin at $3K. He further stated that with the ratio between the BTC and ETH at 0.25, ETH may have a great upside and the possible values may be estimated at 12,000 to 62,000.

Lee cited an increase in activity by such institutions as BlackRock and JPMorgan as a part of a larger development on Ethereum networks. He also disclosed that his fund holds over $11 billion in ETH and continues to accumulate.

His comments brought a macro lens to current market analysis, reinforcing existing narratives around long-term positioning. While traders react to near-term technical behavior, institutional trends form another dimension in the ongoing discussion surrounding ETH. This convergence of technical resilience and fundamental strength positions Ethereum favorably for future developments, including potential scalability enhancements.

Source: Coin Bureau

Coin Bureau reported that only 8.7% of total ETH remains on centralized exchanges, reaching its lowest level since Ethereum’s launch in 2015. This reduction in available supply has drawn interest from market observers evaluating liquidity conditions.

Lower exchange balances often indicate long-term holding behavior, potentially reducing sell pressure during uncertain periods. Market watchers continue to study this trend to understand how it may shape future price responses when demand shifts.

The data adds another layer to current market discussions, appearing at a time when traders already view technical levels as critical reference points. The combination of low supply and cautious short-term behavior provides context for ongoing strategy adjustments.

Frequently Asked Questions

Why is Ethereum’s exchange supply dropping to decade lows?

Ethereum’s exchange supply is at 8.7%, the lowest since 2015, due to investors shifting assets to personal wallets and staking protocols for security and yield. This trend, tracked by on-chain analytics firms like Coin Bureau, reduces available liquidity and signals confidence in long-term value, potentially limiting downside risk in volatile markets.

How might institutional interest affect Ethereum’s price in 2025?

Institutional interest is boosting Ethereum’s price through substantial inflows into funds and ETFs, with accumulations like Fundstrat’s $11 billion holding. As firms such as BlackRock expand Ethereum exposure, this could drive adoption and valuation higher, especially with network improvements enhancing efficiency for real-world applications.

Key Takeaways

- Technical Resilience: ETH’s $3,000 support holds firm, offering entry opportunities for traders while $3,100 resistance signals potential breakouts.

- Supply Dynamics: With only 8.7% on exchanges, reduced sell pressure supports long-term holding and may amplify price surges on positive news.

- Institutional Momentum: Experts like Tom Lee see undervaluation, urging investors to monitor fund accumulations for insights into broader market shifts.

Conclusion

Ethereum price support at $3,000, combined with plummeting exchange supply and robust institutional backing, paints a picture of underlying strength in a cautious market. As traders navigate short-term technical zones and analysts like Lennaert Snyder and Tom Lee provide macro perspectives, the asset’s fundamentals continue to solidify. Looking ahead, sustained holder activity and network innovations could propel Ethereum toward higher valuations—investors should stay attuned to these developments for strategic positioning.

Source: https://en.coinotag.com/ethereum-holds-3k-support-as-exchange-supply-hits-decade-lows