Exchange Reserves Drain: XRP Faces Historic Supply Crunch

XRP exchange reserves hit historic lows on Binance as institutional ETF inflows exceeded 900M. The supply shock increases with accelerating withdrawals.

XRP is facing a supply crisis of its kind. Binance reserves went down to all-time lows. Simultaneously, there was an institutional demand boom in the form of ETFs.

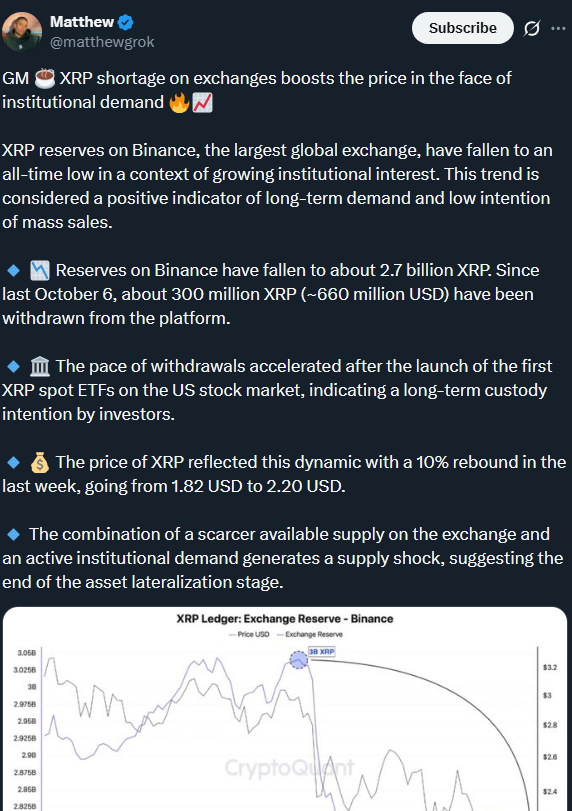

The biggest exchange in the world experienced dramatic withdrawals. It is estimated that since the 6th of October, 300 million XRP have disappeared from Binance. Platform reserves have reached 2.7 billion tokens. This is the lowest level in history.

The combination, as described by matthewgrok on X, is a classical supply shock scenario. Little supply available is subject to aggressive institutional purchases. The exodus is motivated by long-term custody plans.

Source: Matthewgrok on X,

The price reacted instantly to the tightening. XRP surged from $1.82 to $2.20 last week. That is a 10 percent recovery amid market skepticism.

The ETF Catalyst Nobody Expected

After the introduction of spot ETFs in November, withdrawals increased. The timing discloses the institutional accumulation patterns. Conventional investors transferred XRP to highly regulated custody.

The ETF amassed hit maniacal levels as LordOfAlts tweeted about it on X. The fifteen days generated purchases of 861 million. ETFs have taken almost a quarter of the total supply.

As long as this continues, the chart will not long remain quiet, LordOfAlts warned. Something sudden comes quickly.

The inflows are remarkably consistent on a daily basis. On Wednesday, XRP ETFs received $50.27 million on their own. According to RipBullWinkle on X, total assets are now near $906 million.

You might also like: XRP Supply Shock: What Experts Say Will Trigger Price Surge

Supply Vanishes Behind The Scenes

Whales amass spot holdings. Corporations accumulate XRP as treasury coffers grow. ETF scaling is not yet reflected in prices.

RipBullWinkle wrote on X that there is no proportional movement in price. Instead, supply is thinned behind the scenes. Silently, the XRP supplies shock loads.

Exchange reserves narrate a captivating tale. According to Arab Chain data, XRP-to-total-supply ratios have fallen to annual lows. Exchanges are replaced by tokens in private wallets.

Darkfrost is an on-chain analyst who sees the withdrawals as a bullish indicator. Investors transfer holdings into cold holdings. The long-term conviction substitutes short-term speculation.

The trend is not limited to Binance. The same trends are recorded in other key exchanges. Liquidity in the world moves to institutional custodianship.

What Happens When Supply Runs Dry

Past experiences indicate that it will be an explosion. The decline in exchange reserves is usually a precursor of big rallies. A shortage of supply increases the pressure to buy exponentially.

CryptoQuant reporting shows institutional footprints in withdrawals. A majority of XRP does not find its way back to rival exchanges. Tokens are held in cold storage, which is linked to ETF custodians.

The present rate is projected to have dramatic endings. The weekly withdrawals are 45-55 million XRP. By the end of the year, Binance might reach 2.65 billion.

That level is important in terms of price dynamics. The last time Binance reached these levels, institutional demand was low. Present circumstances are not similar to historical cycles.

Technical resistance is at $2.40-2.50 levels. Breaking through may create institutional FOMO buying. The lack of supply would increase any momentum exponentially.

The post Exchange Reserves Drain: XRP Faces Historic Supply Crunch appeared first on Live Bitcoin News.

You May Also Like

Binance Visits Pakistan as Country Preps Major Crypto Policy Push

BTC broke through $91,000, with a daily increase of 1.62%.