Passive Income in Crypto: Why Waiting for Altseason Is a Bad Strategy

What Actually Works in 2025

Bonds Go On-Chain

One of the fastest-growing segments in crypto is tokenized real-world assets. According to CoinDesk, more than $5 bln has already been unlocked through tokenized US Treasuries as of mid-2025.

This is not a fantasy product; it mirrors government bonds but with the accessibility of digital assets.

Somewhat like a bank in mechanics, but more rewarding. ==Coinhold pays 14%==

A simpler option is crypto savings accounts. They let you deposit assets and earn yield over time. Coinhold is built for those who value both profit and safety.

Every payout is backed by formal agreements with EMCD, which secures the income stream at a regulatory level. At the same time, there’s flexibility: you can withdraw up to 50% of your funds anytime, while the rest keeps working.

Staking Isn’t New. Restaking Is Next

Classic staking remains popular, though risks differ by network.

Some chains offer attractive returns, but liquidity lock-ups and validator risks should not be ignored. Unlike tokenized bonds or accumulative wallets, staking depends on network stability and governance. Still, it can complement other strategies if managed carefully.

In 2025, restaking became a buzzword. It allows users to reuse already staked assets for additional yield across multiple protocols. Cointelegraph notes that this practice can generate layered rewards, though it also increases exposure to smart contract risk. It is not risk-free, but for active managers it is a way to stretch the utility of locked tokens.

Lending: The Backbone of Passive Income

Lending remains a backbone of passive income. Whether through centralized lenders or DeFi platforms, users earn by providing liquidity to borrowers.

Yields vary depending on the asset and demand, but the risk is tied to counterparty stability. The lending market has matured: weaker players have left, while the established platforms now focus on safety and transparency.

This evolution makes lending one of the strongest pillars of passive income in crypto, even as it adapts to regulatory changes and occasional liquidity challenges.

Yield Farming: Not Dead, Just Smarter

Yield farming is not dead — it is just less hyped. By providing assets to liquidity pools, investors earn a share of fees and bonus tokens.

This can be lucrative during market activity, but impermanent loss and contract vulnerabilities remain serious risks. Farming is more speculative than holding treasuries or wallets, yet it still attracts those chasing higher yields.

When JPEGs Pay Dividends

Some NFTs now pay dividends, mimicking equity-like income. Others can be rented out in gaming or metaverse projects.

Platforms such as reNFT make it possible to generate yield from otherwise idle collectibles.

The market is niche, fragmented, and risky, but it shows how passive income concepts extend beyond fungible tokens.

Passive Yield Goes Mainstream

New products are showing up not only for funds but also for everyday investors. In the US, for example, a Solana staking ETF recently launched — an exchange-traded fund that automatically stakes Solana tokens and delivers around 7.3% annual yield, all through a regular brokerage account

At the same time, major asset managers are filing for more conservative crypto ETFs built on derivatives and covered-call strategies. The takeaway is simple: passive income in crypto is becoming as familiar an investment tool as stocks or bonds.

Returns in Numbers vs Risks in Details

In crypto there are no risk-free products: stablecoins can lose their peg to the dollar, regulators can change the rules, and platforms can freeze withdrawals or run into glitches.

Many products also come with their own fine print — lock-up periods, minimum deposits, withdrawal fees.

All of this matters far more than promises of ‘up to 20% APY’. For a private investor, carefully checking the terms isn’t bureaucracy — it’s the only way to protect your money and actually earn.

Pick the Tools That Fit You

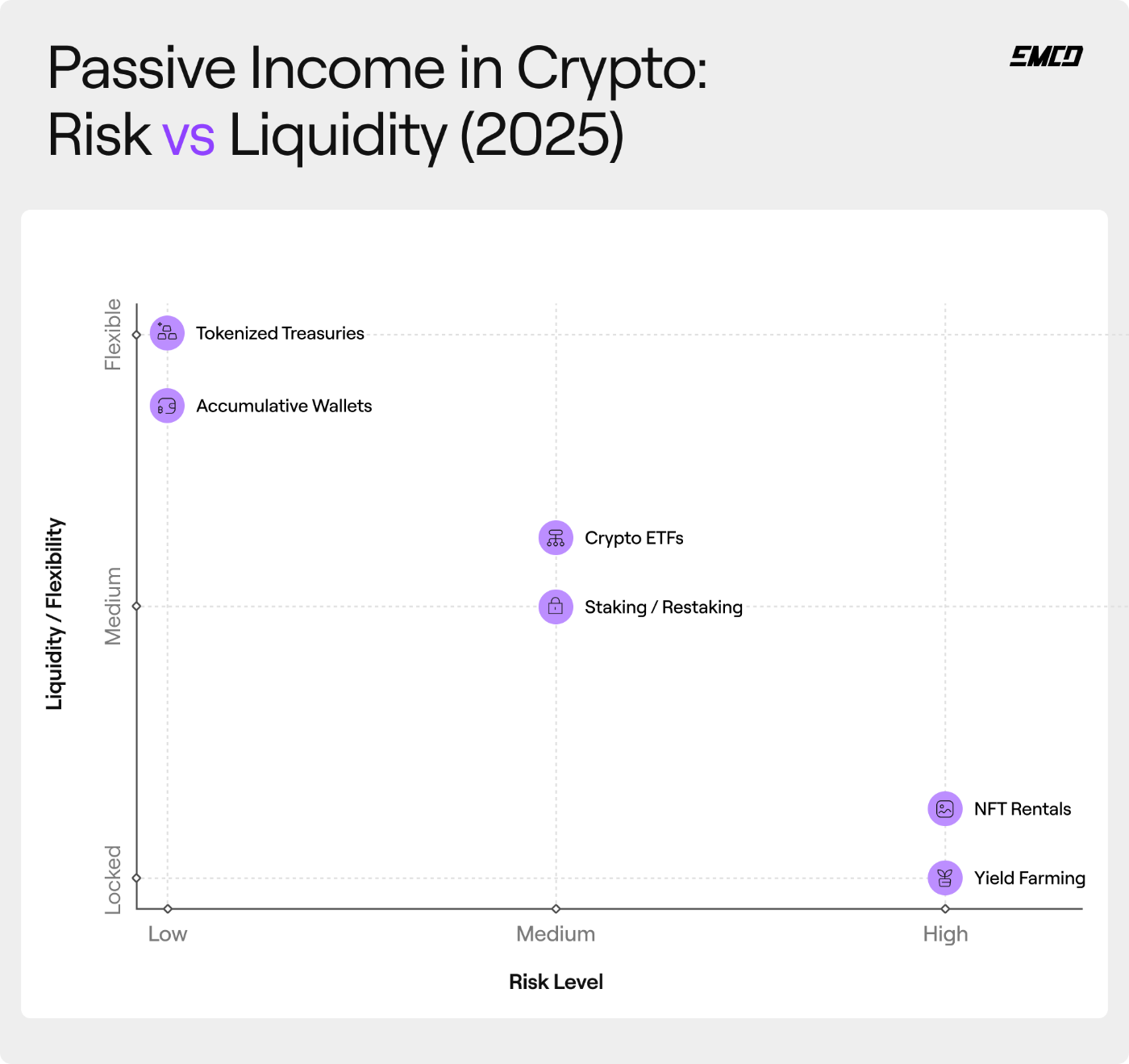

Not all passive income products are the same. Some give you stability and easy access to your money, while others promise higher returns but come with lock-ups and added risk.

The chart below maps out the main strategies for 2025 along two axes — risk and liquidity. It’s a quick way to see where each product stands and figure out which ones make the most sense for you before you invest.

\

The Bottom Line

Altseason may never come. Treasuries, savings accounts, staking, restaking, lending, farming, NFT rentals and ETFs can generate returns in any market.

The bigger picture is that the crypto market is full of opportunities. The real question is not how to make money fast, but which tools you will use to build steady and lasting returns.

What do you think — which passive income strategies in crypto actually work right now?

\n

\ \

You May Also Like

TuHURA Biosciences received FDA Orphan Drug Designation for IFx-2.0 for the Treatment of Stage IIB to Stage IV Cutaneous Melanoma

XAU/USD bounces towards $4,800, remains bearish on the day