Interest in gold-backed digital assets has surged as investors explore alternative ways to gain exposure to gold without the complexities of physical storage. Tether Gold (XAUT) represents a modern solution, offering tokenized ownership of physical gold held in secure vaults. At the same time, traditional investors continue to rely on physical bullion for wealth preservation. This comparison evaluates both investment approaches from accessibility, cost, liquidity, risk, and strategic portfolio perspectives.

What Is Tether Gold (XAUT)?

Tether Gold (XAUT) is a digital token representing ownership of a specific weight of physical gold stored in regulated vaults. Investors can buy, hold, and transfer XAUT on blockchain networks, gaining exposure to gold without handling physical metal. Its value mirrors the global gold spot market, allowing investors to track market movements seamlessly. For live pricing and market updates, you can visit the XAUT price page on MEXC:

https://www.mexc.com/price/XAUT

What Is Physical Gold Ownership?

Physical gold ownership involves holding bullion in personal custody or through professional vaulting services. Investors acquire bars, coins, or other forms, taking direct control over the tangible asset. The key benefits are autonomy, long-term stability, and historical store-of-value properties. However, ownership comes with logistical considerations such as secure storage, insurance, and transaction time when buying or selling.

Key Feature Comparison: Storage, Access, and Control

Tether Gold provides digital convenience. Investors store XAUT in personal wallets and can transfer or trade it instantly through MEXC without worrying about physical handling. Fractional ownership allows flexible portfolio allocation. Physical gold, by contrast, requires careful handling, secure storage, and sometimes third-party custodians. While it ensures direct control, it involves additional costs and operational effort.

Cost Considerations for Investors

Storage Costs

Physical gold must be stored securely, either at home or in professional vaults, often with insurance or rental fees. XAUT removes this burden because custody is handled by regulated vault operators.Transaction and Premium Costs

Purchasing physical gold typically incurs dealer markups, fabrication premiums, and shipping fees. XAUT trades close to market value, with only standard exchange trading fees on MEXC.Liquidity Considerations

XAUT offers immediate liquidity through MEXC spot trading. Physical gold liquidation requires appraisal, negotiation, and transport, which can delay access to funds.

Liquidity and Market Accessibility

Market Availability

XAUT can be traded on MEXC whenever the market is open, allowing for dynamic portfolio adjustments.Settlement Speed

Digital transfers settle quickly on blockchain networks, while physical gold movement can take days depending on logistics.Fractional Ownership

Investors can buy or sell XAUT in fractions, making small allocations practical. Physical gold can also be fractionally purchased but often at higher cost or with less convenience.

For direct trading, you can access the XAUT spot market on MEXC here:

https://www.mexc.com/exchange/XAUT_USDT

Risk Profiles and Security Considerations

Tether Gold relies on the issuer’s transparency and secure vault storage. Investors must manage wallet security and private keys to prevent unauthorized access. Verification of gold reserves is recommended to ensure proper backing. Physical gold ownership removes reliance on issuers but introduces risk from theft, fire, or misplacement, requiring personal security measures or insurance. Each option carries unique operational and custodial risks, influencing investor choice based on risk tolerance.

Suitability for Portfolio Strategy and Investment Goals

XAUT is ideal for investors seeking liquidity, digital transferability, and integration into modern trading strategies. It supports rapid reallocation and global mobility. Physical gold suits long-term preservation-oriented investors who prefer tangible control and minimal dependence on digital infrastructure. Portfolio strategy should consider whether flexibility or tangible sovereignty is the priority.

Conclusion: Which Fits Different Investors

The primary difference between Tether Gold and physical gold is convenience versus tangibility. XAUT enables efficient ownership, immediate trading, and fractional holdings, appealing to active traders and digital-native investors. Physical gold offers direct control, long-term stability, and independence from digital systems, appealing to preservation-focused investors. Both reflect the global gold market, but practical applications vary depending on individual investment goals and operational preferences.

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact [email protected] for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Latest Updates on Griffin AI

View More

TON Price Prediction: Targeting $2.28 Recovery Within 5 Days as Technical Indicators Signal Oversold Bounce

WLD Price Prediction: Targeting $0.73 Breakout Within 4 Weeks Despite Current Consolidation

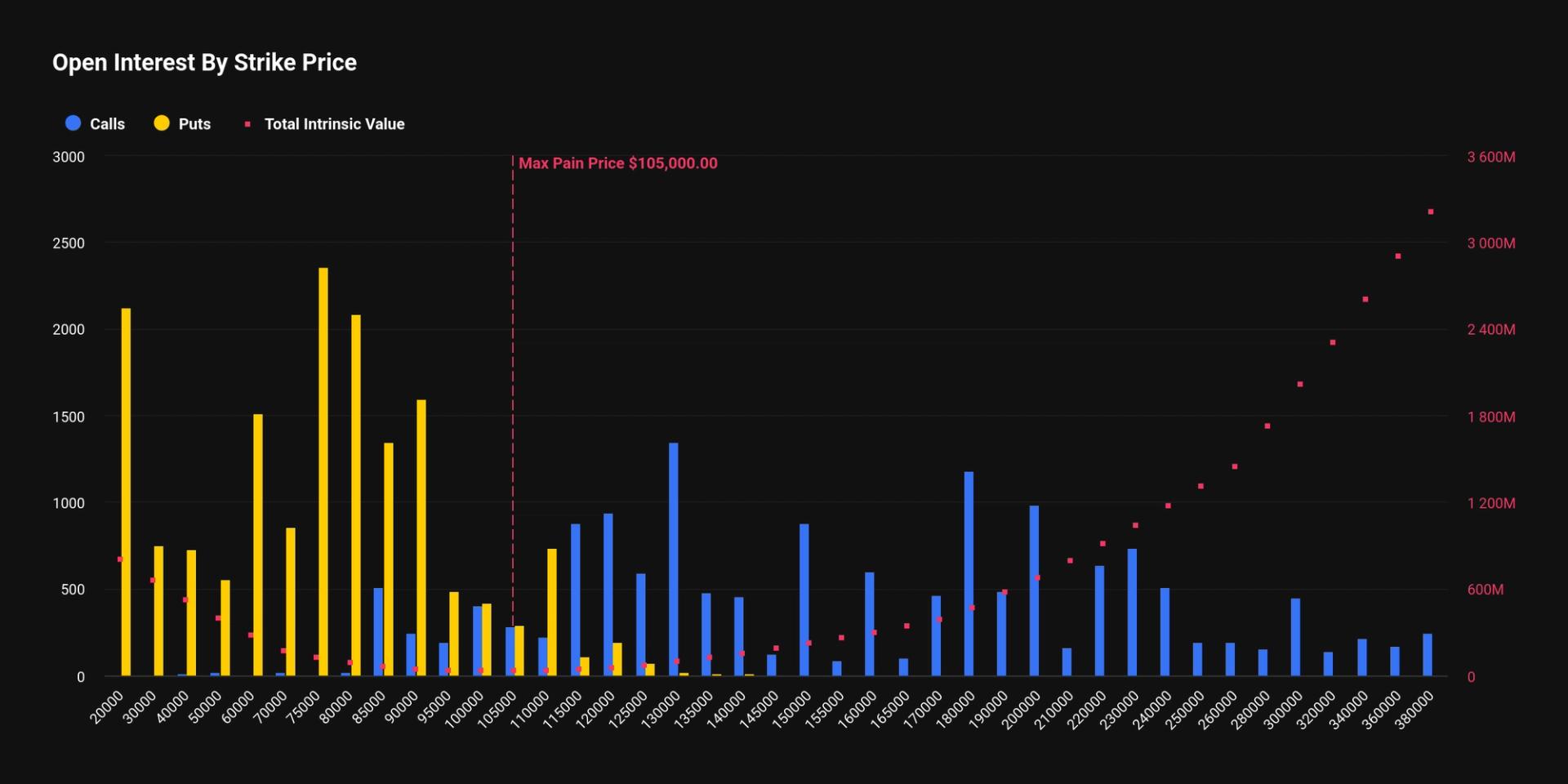

Bitcoin Traders Target $20K Bitcoin Strike as Deep Out of the Money Options Gain Traction

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading