Introduction to AIMon (AM) Price Analysis

The current market position of AIMon (AM) reflects a project in its early growth phase, following its recent listing on MEXC on April 11, 2025. As a newly listed crypto asset, AM is attracting attention from both crypto traders and long-term cryptocurrency investors seeking exposure to innovative AI-driven blockchain solutions. Understanding both short-term and long-term price movements is essential for participants aiming to maximize returns in the AIMon ecosystem, especially given its focus on the intersection of artificial intelligence and blockchain technology.

Several factors influence AIMon (AM) price predictions:

- Development progress on AIMon's core AI and blockchain integration.

- User adoption metrics as the platform onboards new participants.

- Token unlock schedules and supply dynamics.

- Broader market sentiment toward AI-crypto projects.

With only a portion of the total supply in circulation at launch, AIMon's controlled release strategy—implemented by the founding team—creates a unique dynamic for both short- and long-term price analysis.

Short-Term Price Prediction Methods and Strategies

Short-term price forecasting for AIMon (AM) relies heavily on technical analysis tools. Crypto traders commonly monitor:

- Moving Average Convergence Divergence (MACD)

- Relative Strength Index (RSI)

- Bollinger Bands

These indicators help identify potential entry and exit points for crypto trading. For example, the formation of higher lows on the daily chart may suggest strengthening bullish sentiment, while key support levels can be established as the cryptocurrency market matures.

Market sentiment and social indicators are also critical for AM's short-term price movements, especially given its focus on AI-powered information aggregation in the crypto space. Social engagement metrics—tracked by crypto analytics platforms—often show increased mentions across major crypto communities, with sentiment analysis indicating predominantly positive discussions around AIMon's unique features.

Key short-term trading approaches include:

- Swing trading strategies: capturing gains from AM's characteristic multi-day price cycles.

- Day trading: focusing on volume spikes that often precede significant price movements, particularly after platform updates or partnership announcements.

The most successful crypto traders combine technical analysis with fundamental developments to identify high-probability trading opportunities.

Long-Term Price Prediction Approaches

Long-term valuation of AIMon (AM) is grounded in fundamental analysis, focusing on:

- User growth metrics

- Platform adoption rate

- Revenue generation potential of its AI-driven product suite

Cryptocurrency analysts examining AM's long-term potential consider the expanding market for high-quality crypto information, which is expected to reach significant value as the broader cryptocurrency sector matures. AIMon's attention tokenization model shows promise for creating sustainable economic value beyond speculative interest.

On-chain metrics provide critical insights into AIMon's network growth:

- Increasing active addresses

- Growing transaction volumes

- Rising staking participation

A healthy distribution pattern—such as declining concentration among large holders—suggests broader market participation and potential for reduced cryptocurrency volatility over time.

The project's development roadmap outlines several major milestones that could impact long-term valuation, including:

- Expansion of the AI intelligence platform

- Integration with major DeFi protocols

- Launch of additional creator tools within the AIMon ecosystem

As the platform progresses, analysts expect substantial growth in utility-driven token demand, potentially driving price appreciation independent of general crypto market trends.

Factors Affecting AIMon (AM) Value Across Time Horizons

Several factors impact AIMon's value over both short and long timeframes:

- Regulatory developments: As major global economies and emerging markets develop regulatory frameworks for AI and crypto intersections, AIMon's proactive compliance approach positions it favorably.

- Macroeconomic influences: Interest rate policies, inflation trends, and broader technology sector performance all play a role. During periods of economic uncertainty, AIMon's utility as an information curation tool could enhance its appeal.

- Competitor analysis: AIMon faces competition from traditional crypto data aggregators, centralized AI recommendation systems, and emerging Web3 information protocols. Its unique combination of AI capabilities and tokenized incentive mechanisms creates significant barriers to entry.

- Network effects and ecosystem growth: Strategic partnerships with key crypto media platforms further strengthen AIMon's competitive position in the evolving crypto intelligence market.

Conclusion

When approaching AIMon (AM) investments, the most effective strategies combine short-term technical analysis with long-term fundamental evaluation. Understanding both timeframes allows cryptocurrency investors to make more informed decisions regardless of crypto market conditions. For a complete walkthrough on how to apply these prediction methods and develop your own successful trading strategy, check out our comprehensive 'AIMon (AM) Trading Complete Guide: From Getting Started to Hands-On Trading'—your essential resource for mastering AIMon learning in any cryptocurrency market environment.

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact [email protected] for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Learn More About Belong

View More

What is Canton Network (Canton Coin)? Complete Guide to the Enterprise Blockchain

How Long Does It Take to Mine 1 Bitcoin? Timeframes, Costs, and Reality

What Is the Bitcoin Rainbow Chart? How to Use It for Market Analysis?

Latest Updates on Belong

View More

Cardano ($ADA) Price Pattern Points to Explosive Q1 2026

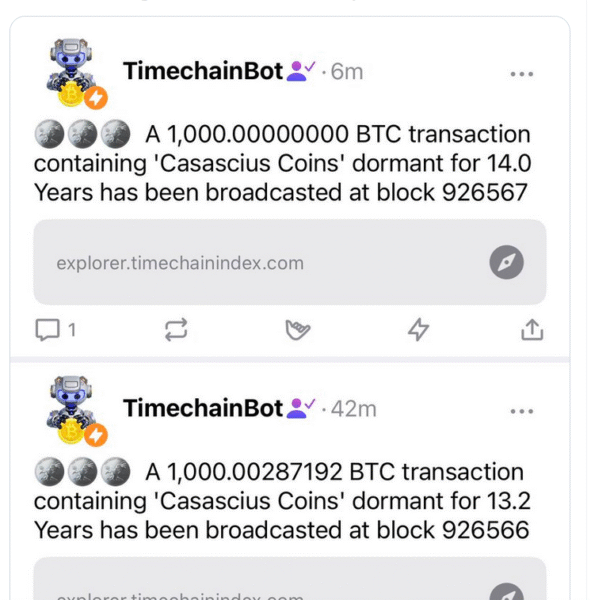

Two Dormant Casascius Coins Unlock $179M in Bitcoin

Japan’s BOJ Rate Hike May Pressure Bitcoin Amid Planned Crypto Tax Reforms

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading